To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

Starting July 1, Covered California for Small Business (CCSB) is offering new Blue Shield plans, providing more options for enrollees. These plans include the Access+ HMO Network with Platinum, Gold, and Silver metal tier options, as well as the Bronze Trio HMO 7000/70. The two most popular Blue Shield High Deductible Health Plans (HDHP), Silver Full PPO Savings 2300/25% and Bronze Full PPO Savings 7000 plans, are also now available.

All of these plans offer benefits such as Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismCarriers are taking substantive action to help employers maintain health coverage for their employees. Get the latest carrier information on maintaining coverage in the event of a:

Visit our COVID-19 Broker Resources for details on carrier actions to keep employees covered.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.

The paid leave provisions of the Families First Coronavirus Response Act (FFCRA) became effective April 1, 2020. With many California small businesses subject to the new law, business owners are turning to their advisors for support in assessing and implementing it.

The information below will provide you with a high-level understanding of the new law’s provisions, the concerns of small business owners, and the resources available.

The Families First Coronavirus Response Act (FFCRA) requires certain employers to provide their employees with paid sick leave and expanded family and medical leave for specified reasons related to COVID-19. These provisions apply from April 1, 2020, through December 31, 2020.

The paid leave provisions apply to, among others, private employers with fewer than 500 employees.

Generally, covered employers must provide to employees who are unable to work due to qualified COVID-19 reasons:

The FFCRA provides employers refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing this leave.

Small Business Exemption: small businesses with fewer than 50 employees may qualify for an exemption to provide leave for the school closure reason if the leave requirements would jeopardize the viability of the business. The rules governing this exemption are quite specific.

While small business owners are trying to best accommodate the health and leave needs of their employees, many are concerned about the burden that the law’s provisions – especially the 12 weeks paid expanded family and medical leave – will place on the viability of their business. And for this reason, many owners of businesses with fewer than 50 employees are also showing strong interest in the “fewer than 50 employees” exemption.

Below are some resources that will help you help your small business clients navigate the FFCRA.

US Department of Labor (DOL) has published a COVID-19 resource page to provide employers with information on, among other issues, the paid sick leave and expanded family and medical leave provisions of the FFCRA, including:

This helpful FFCRA flow chart (courtesy of Filice Insurance Agency) provides a visual step-by-step guide to assessing if an employer and employee are subject to the FFCRA provisions

Visit our COVID-19 Legislation & Regulations FAQs for answers to frequently asked FFCRA questions from brokers and their small business clients.

Claremont’s HR Partners Mammoth HR and HR Service, Inc. both provide resources to help small businesses with the FFCRA.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.

As the Coronavirus continues to advance, many employees are left feeling nervous and anxious. To help quell growing fears and cope with uncertainty about the Coronavirus, employers should educate employees on prevention and symptoms, and make them aware of the many options for accessing care through their health plan.

Both Blue Shield and UnitedHealthcare provide helpful resources that outline the options for accessing care.

Blue Shield members can access care through urgent care centers, Heal, Teladoc, virtual visits, NurseHelp, CVS MinuteClinic, and more.

So Many Options for Care

A guide on how to access the many different care options and the cost implications for PPO and HMO members.

Heal On-Demand Physicians

A service that lets you see a doctor at a time and place that’s best for you. Schedule visits from 8 am – 8 pm, 365 days a year. A medical assistant travels with the physician on these visits.

Teladoc

Embedded in all small group plans, Teledoc provides convenient physician visits via phone or video conference. The changes below are effective January 1, 2020:

Member Coronavirus Resources

The latest COVID-19 updates, help with COVID-19 coverage, telehealth options, emotional health, and more.

Heal

Provides on-demand doctor house calls from 8 am to 8 pm, 7 days a week. Book a house call with a licensed, vetted doctor. In-network with CA PPO Select Plus and Core members. Only available in select cities, visit heal.com for more details.

UnitedHealthcare’s free 24/7 emotional support line is available to anyone, not just members, to call any time at 866-342-6892. This Optum Help Line is staffed by professionally trained mental health experts. It is free of charge and open to anyone.

Sanvello, a free on-demand emotional support mobile app, is available to help members cope with stress, anxiety, and depression during the COVID-19 pandemic.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Good news. Your small business clients can continue to pay employees and fund their benefits through new no-cost, forgivable government loans.

The new loans are available through the Small Business Paycheck Protection Program, part of the CARES Act that became law on March 26, 2020. These loans are for employers with fewer than 500 employees. Depending on the employer’s use of the loan, up to 100% of the loan may be forgiven.

Depending on your business structure your business may too be eligible for Paycheck Protection Program loans.

Gain a high-level understanding of the new Paycheck Protection Program, ensure your small business clients are aware of the program and be positioned to provide resources. Claremont is here to help you with the information you need now.

At its core, the Paycheck Protection Program provides federally-backed loans to small businesses that are forgiven as long as payroll costs are maintained equal to what they were before the Coronavirus impacted the business. Many financial experts are explaining that in essence, the loans become grants if the business maintains its payroll costs.

You can find more details in the Resources section below.

The US Chamber of Commerce Paycheck Protection Program guide helps small businesses understand the Paycheck Protection Program and file for a loan.

The US Department of the Treasury Paycheck Protection Program web page includes several helpful resources, including a Paycheck Protection Program Factsheet for Borrowers that provides even more details.

The US Small Business Administration (SBA) Paycheck Protection Program web page provides information on the program, who can apply, how to apply, loan details and forgiveness, and more.

Claremont Insurance Services and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.

Late last week California regulators issued guidance requiring all commercial health plans to provide coverage for medically necessary Covid-19 screening and testing at zero cost-sharing.

All major California carriers have since announced their zero cost-sharing coronavirus policy. Get the details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

The Coronavirus health concern is resulting in more employees and their dependents staying home, either for work or as a health precaution. Now is a good time for employers with a qualifying Blue Shield or UnitedHealthcare plan to remind employees of the availability of physician home visits through Heal.

Heal lets members see a doctor at a time and place that’s suitable for them. Using the Heal app, members can schedule a licensed pediatrician, internal medicine doctor, family practitioner or general practitioner to come to them on their schedule.

Heal is available to members enrolled in qualifying plans in certain geographical areas. To learn more, download the Blue Shield and UnitedHealthcare product brochures.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.

Designing benefits plans to help workers manage and maintain their health and finances — and thus remain engaged and productive at work — is a top priority for companies around the globe.

Employers understand that their benefits can be instrumental in shaping the type of organization they are and the way their employees — and their peers — perceive them.

The challenge of providing benefits that satisfy everyone is leading employers to reassess their benefits packages to provide greater benefits choice and flexibility to meet a growing and broader range of needs. The good news – technology advances are reducing some of the roadblocks associated with providing greater choice with the emergence of flexible and streamlined administration platforms that enable a more efficient and customized benefits delivery approach.

According to the Willis Towers Watson 2019/2020 Benefit Trends survey, the key challenges facing employers are:

Employers plan to add more voluntary benefits.

For brokers, this means there’s a great opportunity to win more sales. These benefits can be essential to employee recruitment and retention plans, especially with today’s record-low unemployment numbers.

Employees are seeking better choices.

To mitigate the bad news of rising healthcare costs during enrollment and offer the financial protection employees desire, offer them the choice of voluntary benefits.

More interest expected from younger workers.

As millennials and generation Z employees try to protect their assets, there’s an increased interest in voluntary benefits. When explaining the value of voluntary benefits to these savvy consumers, show them how they can offer a financial shield and cite examples that are relevant to their lifestyles.

Solutions for multi-generational workplaces.

Today’s workplaces can include up to five generations. From the silent generation (born in 1945 or earlier) to Generation Z (born in 1995 and after). Addressing the diverse wants and needs of today’s multi-generational workforce is a top challenge worldwide. Voluntary benefits can be the solution that addresses the needs of all generations, protecting wealth at any stage of life.

If benefits packages are to meet the individual needs of today’s multi-generational workforce, employers need to protect core benefits while offering flexibility and choice. Today’s employment deal will need to evolve to encompass a broader range of employee benefits, including voluntary as well as workplace perks. Download the flyer for details.

To learn more about Reliance Standard’s integrated and flexible group voluntary benefits and services, check out their microsite. For articles on topics such as “Growth Opportunities in The Voluntary Insurance Market” and “Why Small Businesses Should Offer Voluntary Benefits,” visit the Reliance Standard Knowledge Center.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.

*Willis Towers Watson’s 2019/2020 Benefit Trends survey.

Valued by both employers and employees, Beam Dental offers:

Beam offers a range of plan options designed to fit the needs of every employer, including:

Every Beam member receives complimentary Beam Perks. The member welcome kit contains a sonic-powered, smart, electronic toothbrush, custom formulated toothpaste, dental floss, and access to the Beam App and Member Portal.

Beam’s SmartPremiums help groups save up to 15% at renewal. When members use the Beam Brush, the group earns a Beam score. The better the group’s Beam score, the lower the group’s premium at renewal.

Premium reduction occurs at renewal (plan year or calendar year) and is based on the group’s aggregate Beam score, prior year claims data analysis, and changes in dentist reimbursement contracts.

Questions?

Contact our small group experts at 800.696.4543 or info@claremontcompanies.com.

Cost concerns continue to be one of the top health care challenges for small businesses.

Address employers’ cost concerns with the Health Care Tax Credit, which provides employer savings of up to 50% on health care premiums for up to two years. Maximize your clients’ savings by moving to them into a Covered California for Small Business plan this year.

Start by estimating the amount of tax credit your clients can realize. Then use our simple turnkey Health Care Tax Credit Solution to ensure your clients get the most for their health care dollars.

Results We’ve Seen So Far:

Bring the Tax Credit value to your clients.

Claremont has been a trusted CCSB partner since its 2014 launch, and we are the top producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact the CCSB small group experts at 800.696.4543 or info@claremontcompanies.com.

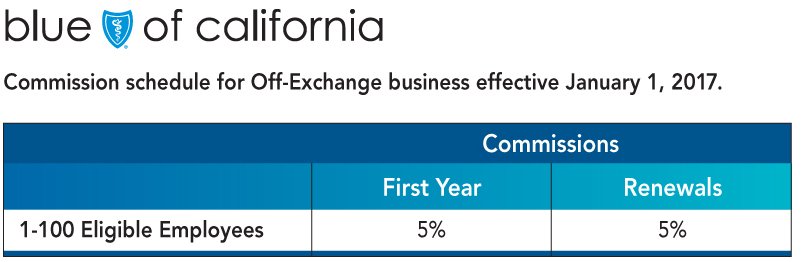

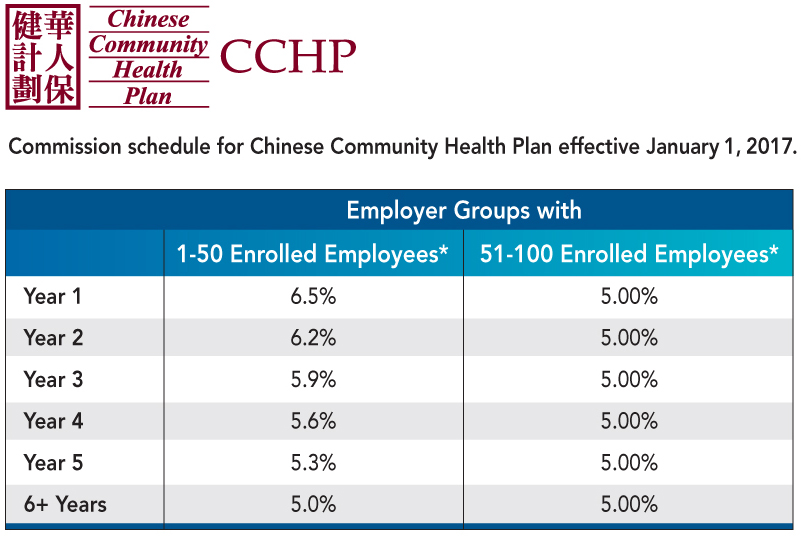

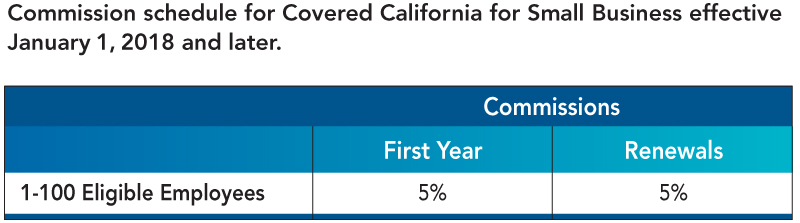

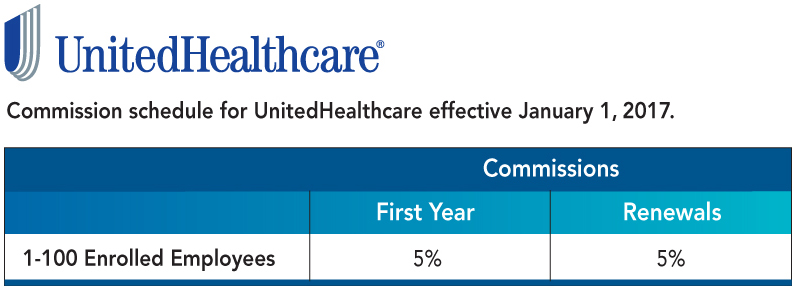

Click on the carriers below to view their commission schedule for 2017:

Blue Shield Specialty Products: 10%

Download the Blue Shield Commission Schedule.

*When annualized premium for a single group reaches $500,001 or more in a contract year, the commission is reduced to 1.0% for amounts over $500,001 for that group.

The sole factor to determine the applicable commission schedule for all groups is the number of enrolled employees in the employer group at the time the employer group enrolls in coverage through Covered California for Small Business.

For Specialty Benefits Commissions download the Schedule.

Please Note:

• The enrolled employee count is re-evaluated at each renewal.

• Existing cases that have effective dates before January 1, 2016, will remain on the commission schedule that is in effect as of their original effective date.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.