To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

Starting July 1, Covered California for Small Business (CCSB) is offering new Blue Shield plans, providing more options for enrollees. These plans include the Access+ HMO Network with Platinum, Gold, and Silver metal tier options, as well as the Bronze Trio HMO 7000/70. The two most popular Blue Shield High Deductible Health Plans (HDHP), Silver Full PPO Savings 2300/25% and Bronze Full PPO Savings 7000 plans, are also now available.

All of these plans offer benefits such as Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismYes. Plan changes are permitted under the following conditions:

This policy applies to both new and renewing CCSB groups.

Consumers may want to purchase outside of the Exchange for more options. There may be plans outside of the Exchange that have richer benefits or better meet the consumer’s needs. However, any plans in Covered California that are also offered outside of Covered California have to have the same benefits and premiums.

It depends on their plans out-of-state benefits.

Out-of-pocket costs are the consumers’ expenses for medical care that aren’t reimbursed by insurance. Out-of-pocket costs include deductibles, co-insurance and co-payments for covered services plus all costs for services that aren’t covered.

The out-of-pocket maximum is the most consumers pay during a policy period (usually one year) before their health insurance or plan starts to pay 100% for covered essential health benefits. This limit must include deductibles, coinsurance, copayments, or similar charges and any other expenditure required of an individual which is a qualified medical expense for the essential health benefits. This limit does not have to count premiums, balance billing amounts for non-network providers and other out-of-network cost-sharing, or spending for non-essential health benefits.

On Friday, August 15, 2014, the Governor signed into law Senate Bill (SB) 1034, which prohibits a health benefit plan for group or individual coverage from imposing a waiting or affiliation period before coverage becomes effective.

The intent of SB 1034 is to prohibit a health care service plan or health insurer offering group coverage from imposing a separate waiting or affiliation period in addition to any waiting period imposed by an employer for a group health plan on an otherwise eligible employee or dependent. Furthermore, the intent of SB 1034 is to permit a health care service plan or health insurer offering group coverage to administer a waiting period imposed by a plan sponsor in accordance with the provisions of the Affordable Care Act (ACA). Hence, an employer may impose a waiting period, however it must comply with the ACA, which prohibits waiting periods that exceed 90 days.

SB 1034 will be effective January 1, 2015, however, carriers may choose to incorporate this change prior to the effective date. This applies to non-grandfathered and grandfathered plans.

All individual health insurance plans sold through the Covered California exchange will now include pediatric dental benefits for members younger than 19. Additionally, Covered California is offering new family dental plans to consumers who enroll in health insurance coverage in 2015.

The optional stand-alone family dental plans, which offer coverage for adults, will not be available at the beginning of open enrollment, which starts Nov. 15, but are planned to be added in early 2015. Covered California will offer both dental health maintenance organization (DHMO) and dental preferred provider organization (DPPO) plans, giving consumers a choice in the type of plan that will work best for them. There is no financial assistance available for the optional adult dental benefits.

There is no requirement to enroll children in a family dental plan. The family dental plan is optional and is primarily intended to offer affordable dental coverage to adults that was not available in 2014. Families should consider that adding their children to a family dental plan will result in an extra cost for the same dental services they already receive in their standard health insurance plan. The most likely reason to enroll a child in the family dental plan is if a dental provider they prefer for their child is not offered through their embedded coverage.

Below is a list of the pediatric dental coverage embedded with Covered California’s individual health insurance plans.

| Health Insurance Plan Selected | Pediatric Dental Coverage Embedded into Health Insurance Plan |

| Anthem Blue Cross of California | Anthem Blue Cross |

| Blue Shield of California | Blue Shield of California |

| Chinese Community Health Plan | Delta Dental of California |

| Health Net | Dental Benefit Providers |

| Kaiser Permanente | Delta Dental of California |

| L.A. Care Health Plan | Liberty Dental Plan |

| Molina Healthcare | California Dental Network |

| Sharp Health Plan | Access Dental Plan |

| Valley Health Plan | Liberty Dental Plan |

| Western Health Advantage | Premier Access |

Family dental plans are offered from the companies listed below.

| Optional Family Dental Plans |

| Access Dental Plan |

| Anthem Blue Cross |

| Blue Shield of California |

| Delta Dental of California |

| Dental Health Services |

| Premier Access |

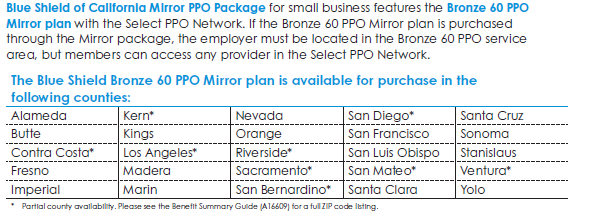

The Blue Shield Bronze PPO 60 plan, with out-of-state coverage through the Blue Card, is available to out-of-state (OOS) employees IF the employer is located in the service area where the plan is offered. Below is the list of counties and/or partial counties where the Blue Shield Bronze PPO is offered.

Normally, employers can only offer two tiers of coverage (Silver and Gold, for example), however, if an employer located in one of the above service areas needs to accommodate OOS employees, Covered California for Small Business (CCSB) will permit the employer to offer the Blue Shield Bronze PPO 60 to OOS members. If the employer is not located in one of the above service areas, then other coverage would need to be considered for these employees. For instance, the employer can opt to offer the eligible OOS employee coverage through the SHOP in that employee’s primary out-of-state worksite.

Note: CCSB had sold plans from Health Net that provided coverage to OOS members, however, in April 2016 Health Net announced that they would no longer cover OOS members. For groups that have existing OOS members on the Health Net plan, they can stay on the plan until the group comes up for renewal. For groups that did not have existing OOS members, they would not be able to add any OOS members after April 2016 so other coverage would need to be considered.

At the group’s renewal, the OOS members do have the option to move to the Blue Shield Bronze PPO 60 plan IF the employer is located in one of the service areas where the plan is offered (see above).

A child-only plan would be suitable, for example, in the following situations:

As long as the carrier continues to offer it, and the plan continues to meet the grandfather requirements.

Covered California plans are organized into categories of coverage, called metal tiers,

based on actuarial value. The idea is to make it easier for consumers to compare coverage

options and tradeoffs. More information on metal tiers can be found on pages 8 and 9 of the Covered CA Plan options participant guide.