To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

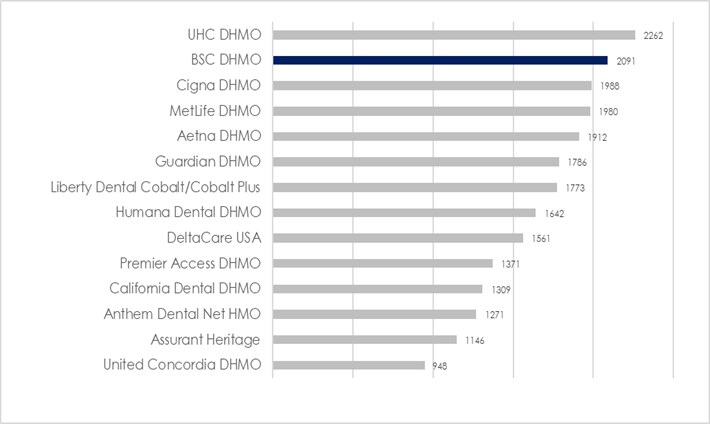

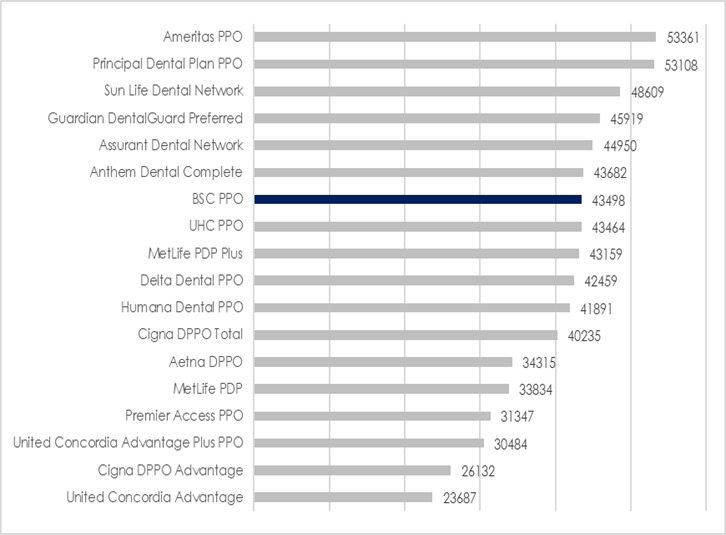

Login To PrismAn important factor to consider when recommending dental coverage options to a client is network strength. A large network minimizes disruption of care and increases member satisfaction. It also maximizes the value of your clients’ plans by giving members access to in-network provider negotiated rates, resulting in significant savings.

With Blue Shield, your clients get access to one of the largest dental HMO and PPO networks in California and nationwide. What’s more, small groups that bundle medical and dental coverage get a 10% discount off of their dental premiums, while large groups (101-1,000 employees) receive a 2% discount off of Blue Shield medical rates. Plus Blue Shield Dental plans now come with a two-year rate guarantee.

Blue Shield’s Dental Network

Learn about all the Blue Shield Dental plans and benefits.

1Figures are for unique locations based on April 2021 Network 360 data.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.