To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To Prism

According to the recently released Ease 2021 SMB Benefits and Employee Insights Report that focuses on the last three years (2018-2020), business decision makers are coping with healthcare increases by seeking ways to balance meaningful access and quality care with affordability. The report also offers a glimpse into how COVID-19 impacted SMB benefits, as well as shifted the way employees interact with their benefits.

With data collected from 2,000 health insurance agencies, 75,000 small businesses, and 2.5 million employees nationwide that use Ease, the Report found a continuation of the rise of healthcare costs and a sustained need to offer competitive total rewards packages, all while seeking new and innovative ways to contain mounting costs.

The Report Features Insights and Trends On:

Medical premiums for families and individuals continue to steadily rise, with rate increases eclipsing the rate of inflation for 2020. The average company in Ease saw an increase in individual medical premiums of 5.98%, while family medical premiums increased an average of 3.74%. These increases pose unique challenges to businesses as they try to contain costs while offering quality healthcare.

In 2020, companies that use Ease contributed an average of 73.97% to their employees’ individual medical premiums (down from 74.24% in 2019) and 59.12% to family medical premiums (unchanged for the past three years). This suggests that while premium costs continued to rise, employers’ costs remained fixed, passing the increase onto their employees.

Over the last three years, employers have reduced the number of medical plans offered by about 3%. By controlling and shrinking the number of medical plans available to employees, companies are able to steer their employees to selecting more affordable plan options, such as High Deductible Health Plans (HDHPs).

Voluntary benefits help supplement the gaps found in core medical plans, and are a smart way for companies to attract talent. Typically, the larger the company, the more voluntary benefit plans offered per employee. On average, the number of voluntary benefit plans offered per employee has increased by approximately 3% since 2018. The most popular plans are dental, vision, life, AD&D, and short- and long-term disability.

Businesses with:

Throughout 2020, during the pandemic, the key to small business survival is anticipation and adaptation. Small businesses forced to do more with less are in greater need of the right tools and technology to supplement tasks and activities previously handled by employees.

With the rise in unemployment and market volatility in 2020 as a result of COVID-19, certain industries were hit harder than others. The five hardest hit industries from a job loss and revenue perspective were hotels, sports and performing arts, furniture and home furnishing stores, restaurants and bars, and motion picture and sound recording.

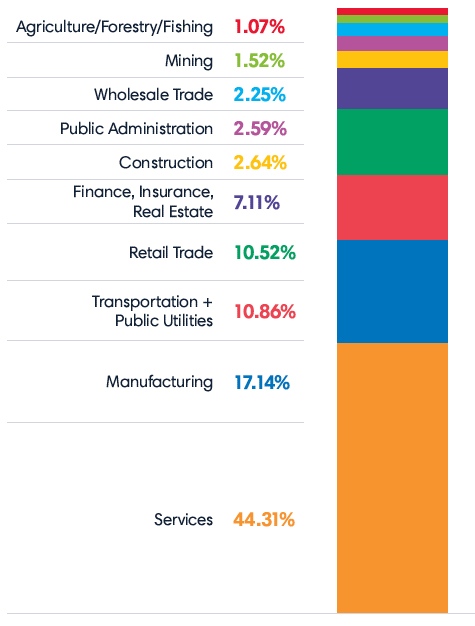

Of the 75,000 SMBs using Ease, the hardest hit industry was services (44.31%), followed by manufacturing (17.14%), and then transportation and public utilities (10.86%).

The largest category within the services segment is business services (47.87%), followed by health services (26.65%), and educational services (just under 10%).

In 2020, Brokers Helped Their Groups with The Following Activities:

Telemedicine rapidly became a necessity in 2020 and the number of employees enrolled increased 109% year-over-year.

Many of the 18 million furloughed workers returned to their companies in the second and third quarters.

To better understand the latest trends in healthcare and voluntary benefits, and advise your clients, download the Ease 2021 SMB Benefits and Employee Insights Report.

Ease is an online benefits enrollment system that makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

The Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.