To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismWith Beam’s short-term disability plans, powered by The Hartford, you can easily offer employers flexible, best-in-class comprehensive disability coverage. Available for California groups of 10+ eligible employees, these guaranteed issue plans offer members financial support with payments starting as soon as the first day of disability for up to 26 weeks.

To learn more, visit Beam Benefits and download these flyers:

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Effective January 1, 2024, Beam Benefits is making some changes to its Value-Added Services for life and disability products.

Employee Assistance Program (EAP)

Beam Benefits is discontinuing the current Employee Assistance Program (EAP) as a value add service with Beam Life benefits plans. This change does not affect your group(s) life coverage through Beam Benefits and the change does not apply to Beam’s new Hartford disability products.

Two New Value-Added Services

Beam Life members can take advantage of two new Value-Added Services at no additional cost:

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With Beam’s new disability plans, powered by The Hartford, you can easily offer employers flexible, best-in-class comprehensive disability coverage. Available for groups of 2-100 eligible employees, these guaranteed issue plans offer members income protection if they’re unable to work for an extended period of time due to an illness or injury. Benefits begin after 90 or 180 days and last through the duration of the disability or until the Social Security Normal Retirement Age (SSNRA).

To learn more, download these flyers:

With quoting available for October 1, 2023 effective dates, now is the time to create customized disability benefits packages tailored to meet your client’s needs and budget.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Beam Benefits’ dental plans are even more competitive with two new enhancements to Orthodontia coverage:

The Orthodontia lifetime benefit maximum is now up to $5,000 (the previous maximum was $2,500). The benefit amount can be selected in $50 increments, starting with $2,550 up to a maximum of $5,000

Previously at least 10 employees were required to enroll in order for Adult & Child Orthodontia benefits to be available. Now Adult & Child Orthodontia benefits are available to groups with as few as two employees enrolling.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Join Beam Benefits, on June 21, 2023 at 11:00 am, for a special one-hour livestream event featuring the latest innovations revolutionizing employee benefits.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Help employers provide extra protection and financial security for their workforce in the event of a serious illness or injury by offering Beam’s new critical illness coverage.

The coverage includes a range of benefits, such as hospital stays, surgery, chemotherapy, and radiation treatments. Plus, it also offers financial assistance for expenses related to caregiving, travel, and other non-medical expenses.

A great option to supplement traditional health insurance, Beam’s critical illness coverage can be especially helpful for those with high-deductible health plans (HDHP).

A valuable addition to standard health insurance, Beam’s critical illness coverage can provide employees peace of mind and financial assistance during challenging times. Download the flyer for details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Help give your clients financial protection and peace of mind with Beam’s two-year rate guarantee on new dental and vision quotes. This promotion is available to groups with 10-499 eligible employees who quote with Beam now through June 30, 2023, with an effective date between April 1, 2023 and September 1, 2023. To learn more, visit Beam and download the flyer.

Beam dental and vision plans are available for 2+ enrolled employees.

Standard Plan Features

Dental Provider Networks

Vision: VSP® Vision Care Plans & VSP® Choice Network

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

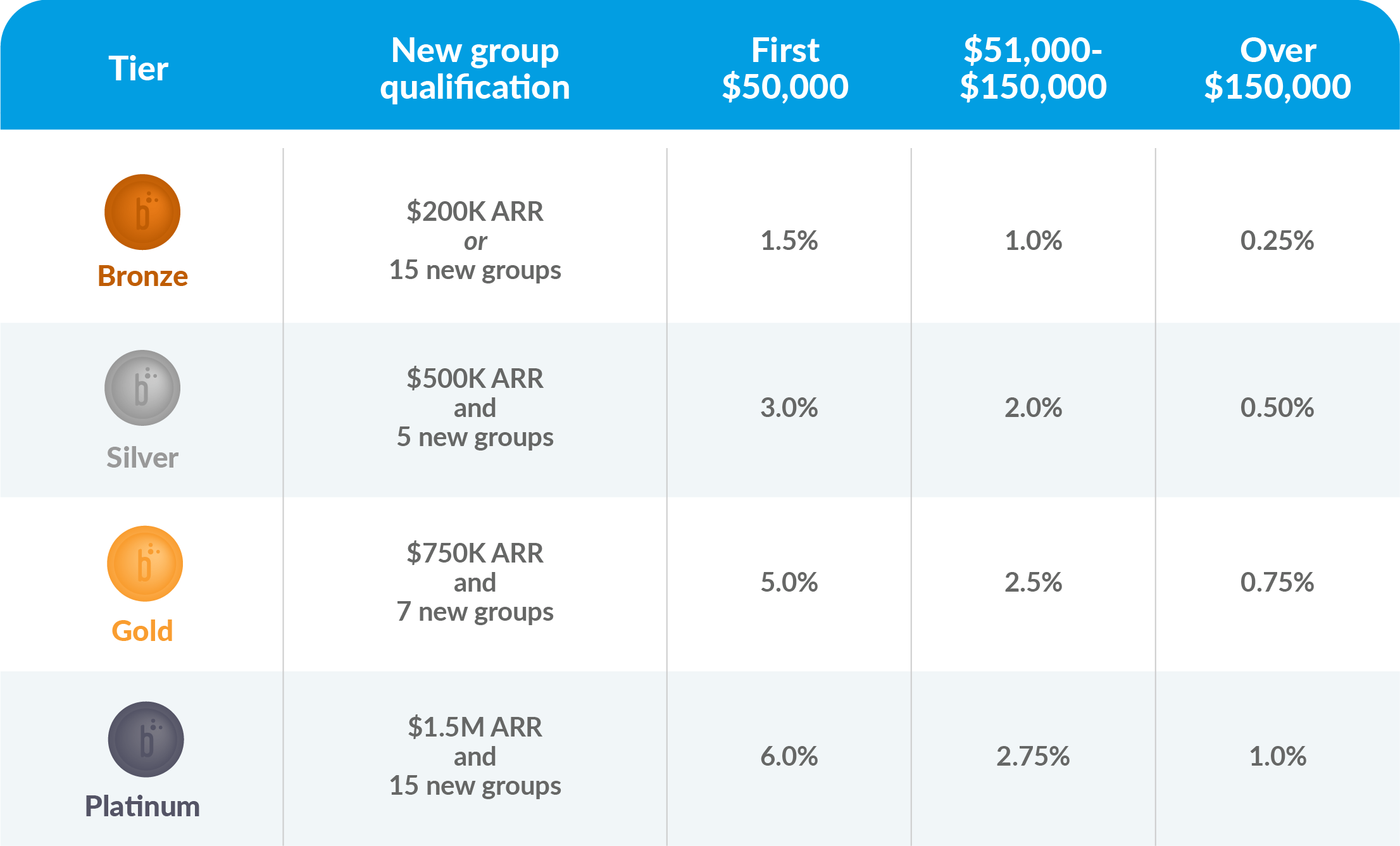

With Beam’s new and improved 2023 Brokerage Bonus Program, there are bigger payouts, opportunities to earn, and expanded eligibility.

Earn up to a 6% bonus (increased from 2.5% in 2022) on collected premiums for new group sales. The more groups you sell, the higher your bonus!

How it works:

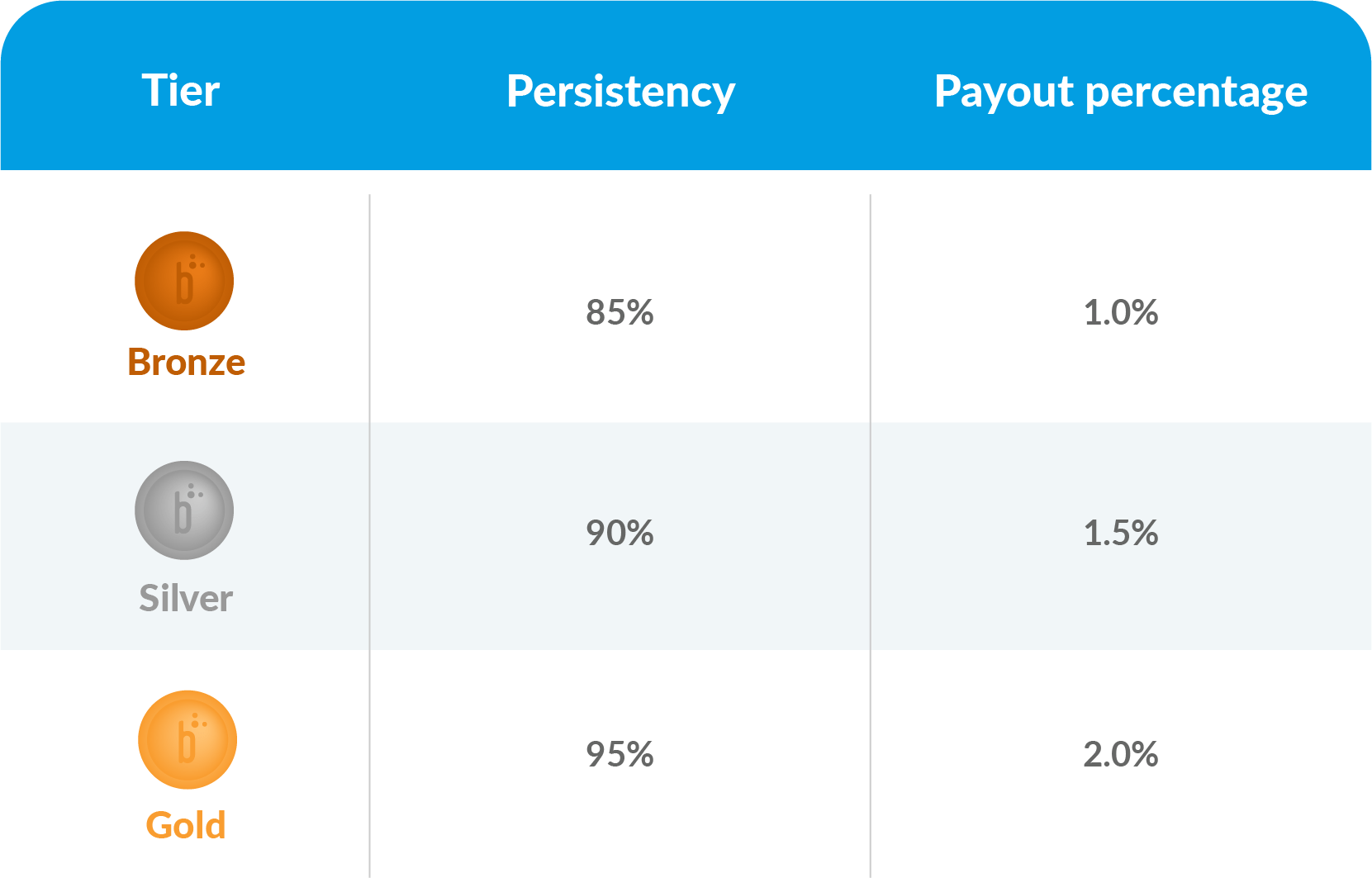

Earn up to an additional 2% bonus on group renewals.

How it works:

Learn more about the 2023 Brokerage Bonus Program.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Beam has announced a two-year rate guarantee on new dental and vision business with 51-499 eligible employees – effective dates from October 1, 2022 to January 1, 2023.

In addition to dental plans with over 400,000 access points nationwide, Beam offers vision, life, disability, accident, and hospital indemnity coverage.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Beam has added voluntary life, accident, and hospital indemnity products to its benefits portfolio. With the addition of these new products, Beam has rebranded to Beam Benefits.

The new products are available with an August 1, 2022 effective date in CA, IL, OH, and TX.

Beam Benefits will continue to launch additional benefits products and will add critical illness to its portfolio later this year.

Beam Benefits provides brokers with a simpler process from start to finish:

With its intuitive online platform, self-service tools, AI-powered underwriting, and thoughtful coverage for improved overall wellness, Beam Benefits simplifies and modernizes the ancillary benefits industry.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.