To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

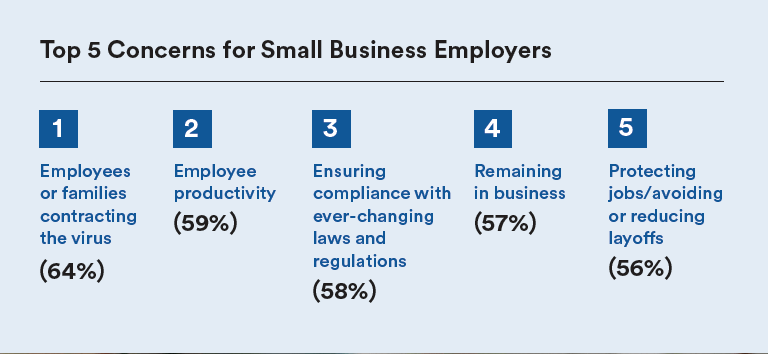

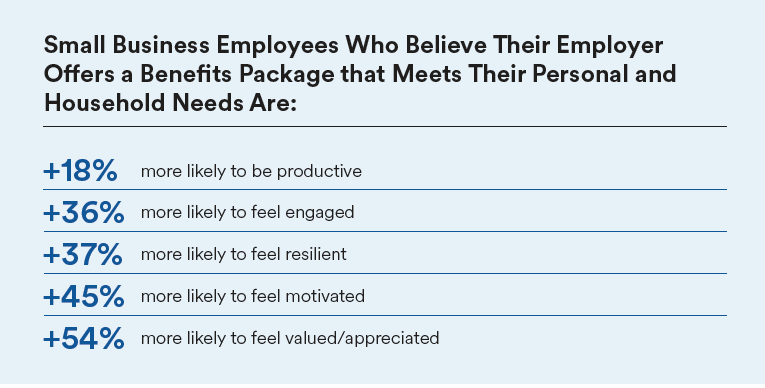

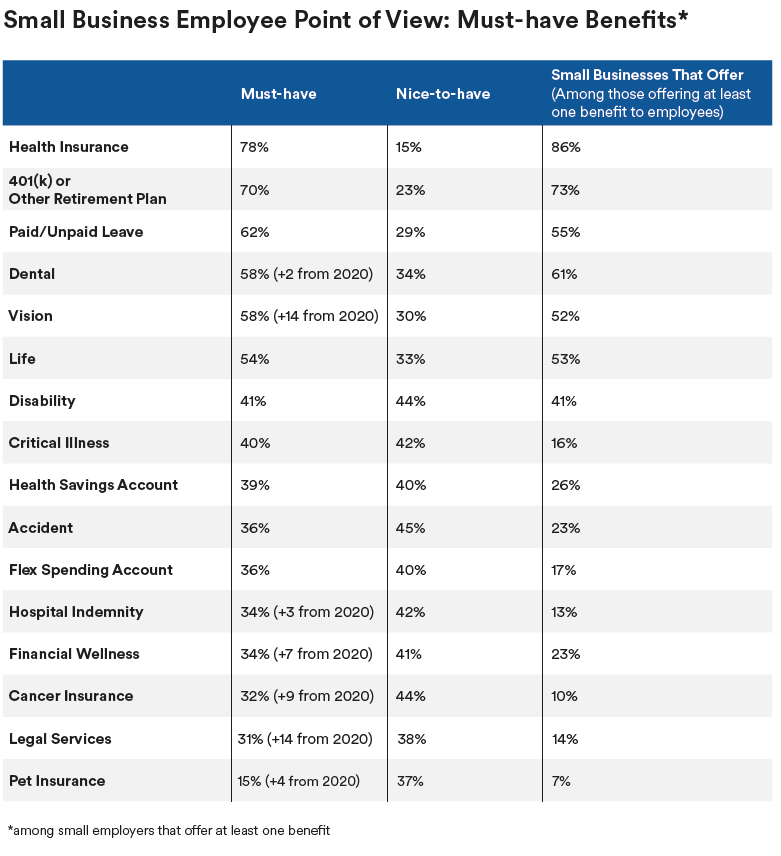

Login To PrismThe ongoing impact of the pandemic has put small business owners to the test as they navigate unprecedented business restrictions, a prolonged economic downturn, uncertainty surrounding pandemic relief initiatives, and the changing work-life environment.

Even as we emerge from some of the restrictions, employees are feeling the pressures of uncertain or heavier workloads, long-term work from home or workplace safety issues, and health and financial concerns. As a result, employees are looking to their employers for support.

Small businesses who understand the shifts in employee needs and expectations, and take steps to enhance their well-being, will have a more productive and successful workforce.

MetLife’s report, How Small Businesses Can Adapt to the Trends Transforming the Workforce, provides insights from their 19th annual U.S. Employee Benefit Trends Study 2021 to help brokers tailor their strategies based on workplace trends, small business employer and employee concerns, and the far-reaching implications of the pandemic.

Inside the Report, You’ll Learn:

Key Findings:

Download the MetLife Report for insights, guidance, and expertise to share with your clients and prospects. Contact us today to develop tailored benefits solutions that address your clients’ needs.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

According to the 2021 State of HR Survey, conducted by ThinkHR from October 12, 2020, to November 9, 2020, responses from 2,200 professionals revealed small-to-medium employers were still dedicated to the health and well-being of employees, even after a tumultuous year with countless human resource and compliance challenges.

ThinkHR’s 2021 State of HR Report dives into employers’ challenges with understanding and complying with laws and regulations that hindered their ability to focus on their employees, in addition to their need for help with complex issues and administrative burdens.

Gain more insights into what small-to-medium businesses are thinking this year by downloading the 2021 State of HR Report.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Due to the pandemic, dentistry has changed and the effects on how dental procedures are performed and access to care may be permanent. Below are the evolving trends and how Blue Shield of California is addressing this changing environment.

Dental Care Trends

Dental Provider Trends

How Blue Shield is Addressing These Trends

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

The Paycheck Protection Program (PPP) was reopened on January 11, 2021 with updated eligibility requirements and the possibility of a second loan for the hardest-hit small businesses. The new guidelines make it easier for businesses to obtain a first-draw PPP loan and a second-draw PPP loan to be used for eligible payroll and non-payroll expenses, including technology. Software and cloud upgrades, for example, are recognized as critical expenses, potentially including payroll, HR, and HCM platforms to digitize operations and support touchless, mobile-friendly solutions.

The PPP loan application deadline is March 31, 2021.

With the continued closures and operation restrictions, businesses have been forced to adapt and stretch resources to stay open. The good news, as of March 14, 2021, more than 7.8 million PPP loans had been approved, providing over $703 billion in relief. Unfortunately, lockdown and work-from-home measures brought about by COVID-19 have disproportionately affected small businesses – particularly in the leisure and hospitality sectors. And nearly a quarter of all small businesses (fewer than 500 employees), which employ roughly half of the country’s workforce, remain closed.

According to the Congressional Research Service, unemployment during the pandemic peaked in April 2020 at 14.8% and remained at a still-elevated 6.7% in December. With support from the Department of Treasury, the Small Business Association (SBA) originally began providing funds via the PPP program in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The Consolidated Appropriations Act of 2021 (CAA), signed into law in December 2020, provided an additional $284 billion in funding, referred to as PPP-2.

With so much of the workforce working remotely and the need to limit in-person contact, organizations dramatically increased the speed of adoption of digital technologies and converted manual, paper-based procedures to digital – from timecards, submitting receipts for reimbursement, and manual paycheck delivery, to taking customer orders. What’s more, many of these changes will be long lasting. According to a new McKinsey Global Survey, companies have accelerated the digitization of their customer and supply-chain interactions and of their internal operations by three to four years. In fact, technology’s strategic importance has become a critical component of business, not just a source of cost efficiencies.

This digitization investment will keep companies agile so they can respond to crises as well as evolve customer and employee demands. Cloud solutions offer key benefits that are critical for small businesses — like scalability, flexibility, cost, innovation, maintenance, and security.

PPP-2 funds can be used for both payroll and non-payroll expenses, including payroll costs, benefits, mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism in 2020, and certain supplier costs and expenses for operations, which includes payments for business software or cloud computing.

The following entities are eligible to apply for a First Draw PPP Loan through the latest wave of funding:

Second Draw PPP Loan Eligibility Requirements for Borrowers

Second Draw PPP Maximum Loan Amount

Second Draw PPP Full Forgiveness Terms

Second Draw PPP Loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement:

To learn more, check out the Paylocity website.

Contact Claremont at 800.696.4543 or info@claremontcompanies.com for assistance when you’re ready to enroll a group in a Paylocity plan.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

President Biden signed into law the American Rescue Plan Act on Thursday, March 11, 2021. The $1.9 trillion COVID-19 relief bill includes several provisions that impact healthcare for both employers and individuals. At the end of this article is a list of helpful resources, including comprehensive summaries and analyses of the Act, an updated ACA subsidy calculator, and upcoming webinars for brokers and employers. Here is a summary of the key healthcare-related provisions.

100% COBRA premium subsidy for any COBRA employee/dependent qualified as a result of involuntary termination or reduction of hours.

Employers will receive a credit for the COBRA premium subsidy through a refundable payroll tax credit against the employer’s quarterly taxes.

The subsidy is effective April 1 through September 30, 2021.

Expansion of subsidies to purchase health insurance through the ACA individual marketplaces:

For 2021 and 2022, premiums for individuals with income up to 150% of the FPL will be eliminated, while premiums for all other households will be capped at 8.5% of their income.

Individuals who underestimate their income for 2020 will not be required to repay any excess subsidies they received.

For individuals who lose their jobs or are eligible for unemployment insurance in 2021, subsidies will be provided to cover the entire cost of their ACA individual marketplace insurance premiums.

For the tax year 2021, the amount that employees may deposit into a tax-favored Flexible Spending Account (FSA) for dependent care expenses will be increased from $5,000 to$10,500.

$7 billion to the U.S. Small Business Administration (SBA) for the Paycheck Protection Program (PPP).

$15 billion to the SBA to provide EIDL $10,000 grants to small businesses.

$25 billion for the SBA to administer a grant program to restaurants through a new Restaurant Revitalization Fund.

Extends through September 30, 2021, the tax credit for voluntary provision of paid sick and paid family leave, as established in the Families First Coronavirus Response Act (FFCRA).

Upcoming Webinars

Overviews of The Act

COBRA

ACA Individual Marketplace Subsidies and Calculator

Flexible Spending Accounts (FSAs)

Law Firm Summaries

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

From February 2 to February 15, 2021, Blue Shield of California/Harris Poll surveyed 1,000 adults in California to gauge access to health care, comfort levels with workplace and public safety, and opinions of healthcare policy.

The Findings Include:

The poll represents Californians who are privately insured, uninsured, MediCal recipients, self-insured and more. It was conducted before Blue Shield of California was tapped by the State of California to oversee COVID-19 vaccine distribution as a third party administrator (TPA).

Access the article and infographic.

Access the Article and Infographic

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Carriers recognize the strain that COVID-19 is placing on employees and their families. Many are expanding access to emotional, behavioral, and mental health services — and in some cases waiving costs.

Download our Carrier Resources Guide to stay up-to-date and advise your employer groups about the available carrier services and benefits available to their employees, either through their existing lines of coverage or through additional lines of coverage they may want to consider.

Carrier Services and Benefits Include:

Get a high-level summary of the services and benefits provided by each carrier by downloading the chart below.

Download The Carrier Resources Guide

To learn more, visit our COVID-19 Broker Resources, and COVID-19 Carrier FAQs and COVID-19 Legislation & Regulations FAQs. If you can’t find an answer to your question, contact our experts at COVID@claremontcompanies.com.

Emotional, behavioral, and mental health resources are also available from government agencies, health systems, and others. Learn more.

Questions?

Contact our small group experts at 800.696.4543 or info@claremontcompanies.com.

Your employer clients and their employees are keen to learn when a COVID-19 vaccine will be available to them and their families. Help them by staying up-to-date with the latest developments below. This page will be updated as new information becomes available.

California will distribute and administer vaccines as soon as they are available. California will be transparent, careful, and equitable in its vaccine distribution. Initially, the vaccine supply will be very limited. At first, vaccines will be provided to healthcare workers and long-term care residents in accordance with the CDPH Allocation Guidelines.

COVID-19 vaccines are currently available only for healthcare workers and residents of Long-Term Care Facilities (LTCFs) due to limited supplies.

COVID-19 vaccines are currently available only for:

Next on the priority list for the vaccination are:

Every Californian can sign up to see if it’s their turn to get the COVID-19 vaccine. If you’re not currently eligible, you can sign up to be notified when it’s your turn.

Spring 2021 is the best estimate, but that may change. It depends on vaccine production and how quickly other vaccines become available.

Most Californians will be vaccinated at:

Blue Shield of California

Members can receive COVID-19 vaccinations, considered a preventive service, at no member cost share and with no provider order. Coverage will be provided for both in-network and out-of-network providers through the duration of the COVID-19 Public Health Emergency.

Additional Blue Shield resources:

UnitedHealthcare

Members will be able to get the vaccine at no charge. Members in employer and individual health plans will have $0 cost-share (copayments, deductibles, and co-insurance) for both in- and out-of-network providers through the national public health emergency period. See the COVID-19 Vaccines FAQ below for more details.

Additional UnitedHealthcare resources:

Federal Government Resources

California State Government Resources

Northern California Health System COVID-19 Vaccine Resources

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Stay up to date on the latest COVID-19 vaccination efforts by attending UnitedHealthcare’s webinar on January 27th at 12:00 pm PST.

Topics Include:

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

COVID-19 relief for Flexible Spending Accounts (FSAs) was introduced in the recent federal government year-end spending bill signed by President Trump on December 27, 2020.

The year-end spending bill provides five opportunities for employers to ease concerns over losing FSA funds. In many ways, the guidance temporarily suspends the “use-or-lose” aspect of an FSA. The temporary rule:

To learn more, check out this BRI article and FSA Relief Considerations Q&A video.

Contact us at 800.696.4543 or info@claremontcompanies.com for assistance when you’re ready to enroll a group in a BRI plan.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.