To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

Starting July 1, Covered California for Small Business (CCSB) is offering new Blue Shield plans, providing more options for enrollees. These plans include the Access+ HMO Network with Platinum, Gold, and Silver metal tier options, as well as the Bronze Trio HMO 7000/70. The two most popular Blue Shield High Deductible Health Plans (HDHP), Silver Full PPO Savings 2300/25% and Bronze Full PPO Savings 7000 plans, are also now available.

All of these plans offer benefits such as Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismWith the continuing uncertainty around COVID-19, businesses are doing their best to reopen and accommodate changing restrictions for conducting business. To help support brokers, employers, and members, Blue Shield has created a Return-to-Work Guide with important steps to help businesses of all sizes and types successfully plan for reopening.

Check out the short video from Don Antonucci, Sr. Vice President, Commercial Markets, to learn what Blue Shield is doing in response to COVID-19 and the types of resources brokers, employers, and members can expect to find.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

As small businesses are forced to adapt to meet changing payment preferences due to the pandemic, offer them solutions from Heartland’s “Guide to No-Contact Commerce” to make buying easier and safer for their customers.

Payment options to meet evolving no-contact commerce needs:

Getting a business online is a big leap forward, however, there’s more to selling online than having a website that can process transactions. A comprehensive strategy is necessary to transition to digital payments.

To successfully implement digital payments, businesses should:

Download Heartland’s “Guide to No-Contact Commerce” to help small businesses:

Heartland’s Guide to No-Contact Commerce

Heartland Payroll (a Claremont partner) is a division of Heartland Payment Systems, a Global Payments company.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

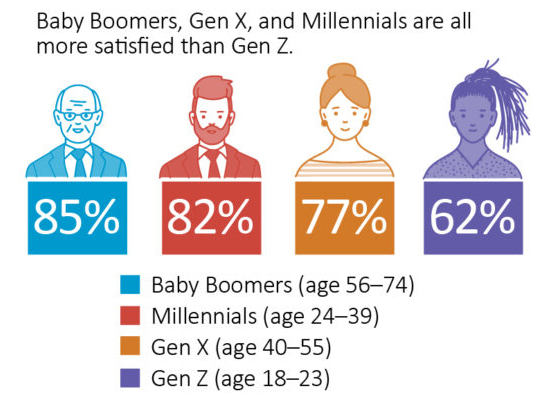

According to the results of a June 2020 American Staffing Association (ASA) Workforce Monitor® online survey conducted by The Harris Poll, more than three-quarters of U.S. employees (79%) are satisfied with their employers’ pandemic-related return-to-work plans.

Eight in 10 men (83%) compared to seven in 10 women (74%) are satisfied with such plans, while generations also differ in their satisfaction levels—with Baby Boomers (85%), Millennials (82%), and Gen X (77%) all more satisfied, and Gen Z (62%) less content.

The top five measures employees cite as critical to feeling safe at work:

However, 7% of employees said nothing would make them feel safe on the job during the pandemic, with health care workers more likely to cite this fear (14%) than those in the professional–managerial (6%) and engineering, scientific, and IT (2%) industries. One in 10 industrial (8%) and office–clerical and administrative (7%) workers also share this concern. Learn more about the ASA Workforce Monitor survey.

Confidently Advise Your Clients with Our Extensive COVID-19 Broker Resources

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Blue Shield will continue to waive co-payments, coinsurance, and deductibles for treatment of COVID-19 for three more months through December 31, 2020. And costs for virtual care (medical and behavioral) services provided by Teladoc Health will also be extended through December 31, 2020. Learn more.

Visit Blue Shield’s Broker Connection to learn more.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

For employers who have been impacted financially by COVID-19, Blue Shield is continuing its Premium Payment Plan Program for the month of August. This program provides a flexible premium payment plan option for employers whose premium payment is delinquent. Get the details.

Visit Blue Shield’s Broker Connection to learn more.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

UnitedHealthcare has extended, through October 22, 2020, their policies waiving cost-sharing for COVID-19 testing-related visits, testing and treatment, as well as telehealth coverage for COVID-19-related services.

To learn more, visit UnitedHealthcare’s Broker COVID-19 FAQs.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Borrowers, especially small businesses, who received Paycheck Protection Program (PPP) loans under the Coronavirus Aid, Relief, and Economic Security Act (CARES) may be ready to apply for forgiveness, but according to the American Institute of Certified Public Accountants (AICPA), final program guidance is not available from the SBA and U.S. Treasury Department.

Factors Affecting the Forgiveness Application Process

To prepare for the forgiveness application process, borrowers can:

Lenders may not request supporting documentation for all disbursements as part of the forgiveness application; however, increased scrutiny is guaranteed for loans of $2,000,000 or more.

To learn more, check out AICPA’s PPP resources. Contact your CPA for assistance with the PPP loan forgiveness process.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

To help brokers and their small business clients get back to work safely and successfully, Claremont’s partner Paylocity has created a series of COVID-19 on-demand webinars (approximately one hour each).

Getting Back to Work

As restrictions start to lift, now is the time for employers to think about how to bring employees back to work and back to the office. That said, there’s a lot to consider, plan, and communicate. Find out what employers need to know to develop a plan, stay compliant, and keep employees safe.

Life After COVID: The New Normal

As a result of COVID-19, some changes may be temporary, but many of them have already come to define our new “normal.” Paylocity’s HR experts discuss employee expectations during and after the pandemic, what the new employee experience has become, and the role resiliency and empathy play going forward.

How to Successfully Re-engage with Employees and Clients

Learn strategies for engaging clients and employees safely and effectively as they return to work, best practices to strategically navigate and implement new guidelines, how to apply new policies and procedures around telecommuting and other related employee rights due to the current health crisis, and how small businesses can implement procedural improvements.

For Partners: Emerging Stronger Together —Successfully Navigating Crisis

Members of the partner community, including benefits brokers, financial advisors, consultants, associations, and more, will learn strategies to help navigate the current crisis and emerge stronger with more resiliency and brand equity.

Getting Through Emergencies, Disasters, Communicable Diseases

See how to support organizations and employees through COVID-19 and beyond. Hear about preparing for emergencies, disasters, and pandemics; implementing preventive measures; managing employees during a crisis; and catastrophic event business recovery.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Blue Shield of California is continuing its Premium Plan Program for the month of July. This program provides a flexible premium payment plan option for employers whose April, May, June and/or July 2020 premium payment is delinquent. Get the details.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Help your clients and their employees understand the CARES Act changes to Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and Health Reimbursement Arrangements (HRAs) with this recap from Sterling Administration.

What is the HSA Contribution Deadline?

The IRS has confirmed that account holders can make contributions to HSAs for the 2019 plan year up to the new filing deadline of July 15, 2020. The IRS states that contributions to an HSA may be made at any time during the year or by the due date for filing that year’s tax returns. This rule applies to the new federal income tax filing deadline for 2020, which the IRS extended in response to the COVID-19 crisis.

Does my HSA Cover COVID-19 Testing and Treatment?

The IRS (Notice 2020-15 on March 11, 2020) allows high-deductible health plans (HDHPs) to cover testing and treatment for COVID-19 without a deductible. Coronavirus testing and treatment are considered qualified medical expenses under an HDHP, and people can use HSA funds to pay for it. Due to the COVID-19 national health emergency, Notice 2020-15 also applies to HDHPs that would otherwise be disqualified under Internal Revenue Code section 223(c)(2)(A). In other words, HDHPs that provide additional health benefits covering Coronavirus testing and treatment, and HDHPs with a deductible that falls below the minimum requirement are also subject to the Notice.

Does the CARES Act Expand the List of Reimbursable Expenses through an HSA? (Over-the-Counter (OTC) Drugs and Menstrual Care Products)

Yes. The CARES Act states that consumers can purchase OTC drugs and medicines (including menstrual products) with funds from an HSA, FSA, or HRA. Consumers may also receive reimbursement for OTC purchases through those accounts. This provision is effective for purchases and reimbursements of expenses incurred after December 31, 2019. No expiration date.

What Has Changed Regarding Telehealth?

The CARES Act states that “telehealth and other remote care services” below the deductible will be permitted in an HSA-compatible HDHP. This provision is effective immediately and will expire on December 31, 2021.

Does the CARES Act Expand the List of Reimbursable Expenses through an FSA? (Over-the-Counter (OTC) Drugs and Menstrual Care Products)

Yes. The CARES Act states that consumers can purchase OTC drugs and medicines (including menstrual products) with funds from their HSA, FSA, or HRA. Consumers may also receive reimbursement for OTC purchases through those accounts. This provision is effective for purchases and reimbursements of expenses incurred after December 31, 2019. No expiration date.

Can Dependent Care FSA Participants Who Have Lost Preschool and Childcare Services Due to Facility Closures Reduce Their DCA Elections or Terminate Altogether?

Yes. Participants can reduce or terminate their dependent care account elections under these circumstances, as their childcare needs have changed. However, account holders are advised to keep in mind that they may not need to change or revoke their plan elections, even if they are not incurring any new dependent care expenses. Account-holders may be able to claim their full plan year elections once the shelter-in-place orders cease, as childcare expenses can often reach the $5,000 annual contribution limit within 2-5 months.

Does the CARES Act Expand the List of Reimbursable Expenses Through an HRA? (Over-the-Counter (OTC) Drugs and Menstrual Care Products)

Maybe. It depends on how the employer’s specific HRA is set up. Reimbursable expense rules under an HRA plan vary from employer to employer, so your HRA plan documents will need to be reviewed.

The CARES Act states that consumers can purchase OTC drugs and medicines (including menstrual products) with funds from their HSA, FSA, or HRA. Consumers may also receive reimbursement for OTC purchases through those accounts. This provision is effective for purchases and reimbursements of expenses incurred after December 31, 2019. No expiration date.

Take the guesswork out of what is eligible with your FSA and HSA plans with Sterling Administration’s partner – the HSA Store and FSA Store. It’s an easy-to-use online shopping platform that offers 24/7 chat and online help.

Use these valuable coupons when shopping.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.