To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

Starting July 1, Covered California for Small Business (CCSB) is offering new Blue Shield plans, providing more options for enrollees. These plans include the Access+ HMO Network with Platinum, Gold, and Silver metal tier options, as well as the Bronze Trio HMO 7000/70. The two most popular Blue Shield High Deductible Health Plans (HDHP), Silver Full PPO Savings 2300/25% and Bronze Full PPO Savings 7000 plans, are also now available.

All of these plans offer benefits such as Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismAfter a record number of cyberattacks in 2020, per the Identity Theft Resource Center, the total number of data compromises alarmingly shot up to above 68% in 2021 from the 2020 level.

As cybersecurity risks continue to rise for individuals, making employees more vulnerable to personal data and identity fraud, there’s been a growing demand from employers looking to offer digital security benefits to their employees.

The workforce prioritizes companies that provide a wide range of benefits and recognize their role in supporting employees’ holistic well-being. In fact, 51% of employees say that employers should play a greater role in the safety and protection of employees and their families, according to MetLife’s 2021 U.S. Employee Benefit Trends Study.

Help your clients drive employee wellness, productivity, and engagement by offering identity and data protection services from MetLife powered by Aura’s intelligent digital security solutions.

With an all-in-one digital theft prevention benefit, Aura helps prevent fraud before it happens, so employees can focus on what matters most. Available to groups with 100 or more employees, employers have a choice of three benefit levels that meet their protection and budget requirements through both employer-sponsored and voluntary plans.

To learn more, download the flyer.

MetLife Identity and Fraud Protection

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Employees needs have changed drastically in just a few short years due to an increasingly diverse workforce, a pandemic, and the lowest job satisfaction rate in 20 years. Today’s workers expect employers to recognize the importance of their lives inside and outside of work.

Benefits are a powerful tool for serving the whole employee and meeting the needs of the entire organization. That’s true not only in the intense competition to win talent, but also in enabling and equipping employees to be their best, both at work and in their personal lives. In this ‘Age of the Employee,’ organizations that offer compelling benefits will be better positioned for success in these uncertain times.

MetLife’s 20th Annual U.S. Employee Benefit Trends Study 2022, The Rise of The Whole Employee: 20 Years of Change in Employer-Employee Dynamics: Reimagining the Healthcare Employee Experience, provides actionable insights to help you recommend a benefits mix for employers that can help them satisfy the complex and divergent needs of their employees.

The MetLife Study Will Help You:

Download the MetLife Study for insights, guidance, and expertise to share with your employer groups. Contact us today to develop tailored benefits solutions that address your clients’ needs.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

MetLife has launched a Health & Wellness Content Library designed to help employers educate, raise awareness, and empower their employees to make informed decisions about their health and well-being. Organizations can utilize this content to launch targeted health campaigns to promote overall well-being and encourage positive behavior change among their employee population.

MetLife Health & Wellness Content Library

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Many California employers have employees who travel globally. Now more than ever, these employees expect benefits that protect them and their families when they’re abroad.

MetLife Worldwide Benefits provides life and disability coverage that protects your clients’ employees when they travel abroad.

Beginning December 15, 2021, MetLife Worldwide Benefits life insurance coverage will include Grief Counseling services at no extra cost to employers and globally-mobile employees.

MetLife life insurance coverage is available to employers with as few as two employees.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

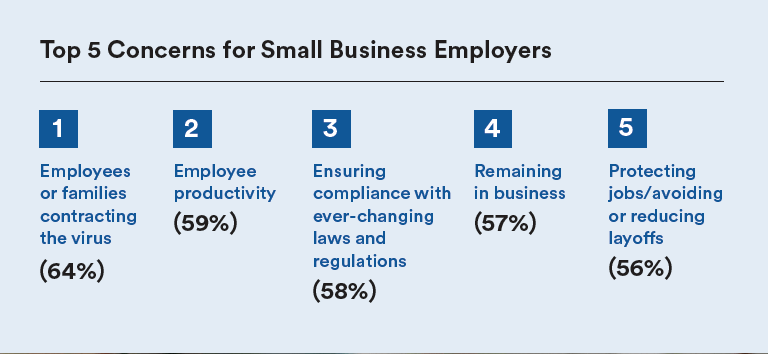

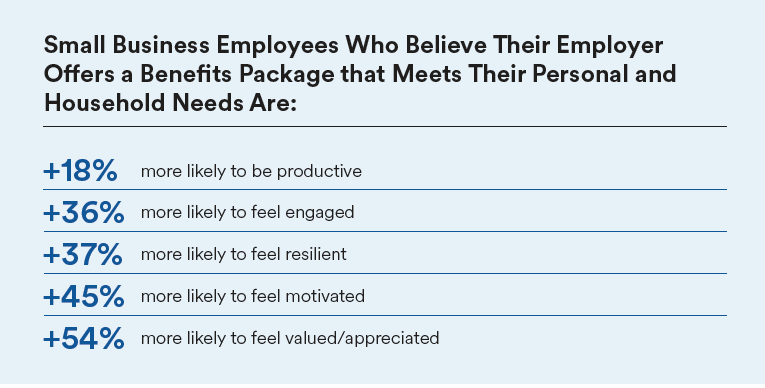

The ongoing impact of the pandemic has put small business owners to the test as they navigate unprecedented business restrictions, a prolonged economic downturn, uncertainty surrounding pandemic relief initiatives, and the changing work-life environment.

Even as we emerge from some of the restrictions, employees are feeling the pressures of uncertain or heavier workloads, long-term work from home or workplace safety issues, and health and financial concerns. As a result, employees are looking to their employers for support.

Small businesses who understand the shifts in employee needs and expectations, and take steps to enhance their well-being, will have a more productive and successful workforce.

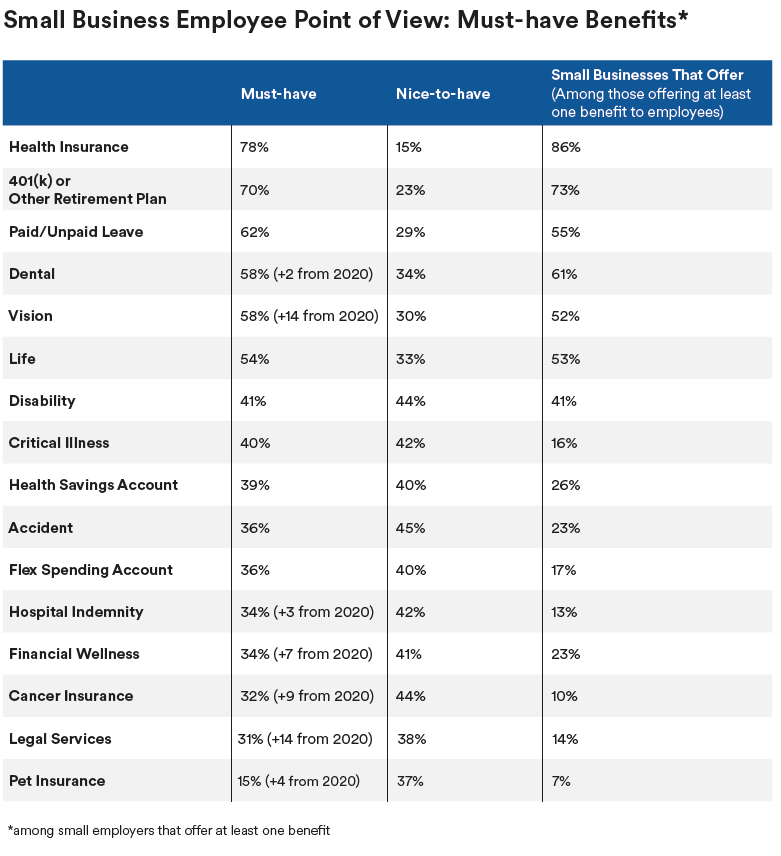

MetLife’s report, How Small Businesses Can Adapt to the Trends Transforming the Workforce, provides insights from their 19th annual U.S. Employee Benefit Trends Study 2021 to help brokers tailor their strategies based on workplace trends, small business employer and employee concerns, and the far-reaching implications of the pandemic.

Inside the Report, You’ll Learn:

Key Findings:

Download the MetLife Report for insights, guidance, and expertise to share with your clients and prospects. Contact us today to develop tailored benefits solutions that address your clients’ needs.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Choosing the right dental benefits can be challenging – especially for a small business. With MetLife, it’s easy to offer a dental plan that helps balance costs while meeting employer and employee needs.

Dental benefits are an important and highly visible part of an employer’s benefits program. Not only do 70% of employees consider dental coverage a must-have benefit¹, but it’s also coverage they’re likely to use regularly. And with each visit to the dentist, they’re evaluating the value of the plan, the savings, and the provider network.

Flexibility to See Any Dentist

MetLife’s dental plans offer a comprehensive range of options to meet employer objectives and diverse employee needs, including the choice of visiting dentists in or out of network.

Extensive Provider Network and Cost Savings²

With a PPO network that includes 521,000+ dentist access points nationwide³, MetLife’s dental plans include network discounts that average 30% to 45% below community average charges4.

MetLife’s high in-network utilization is 6.5% higher than the industry average5, indicating that MetLife offers more savings for the dentists that employees prefer.

In addition, MetLife’s network providers are held to the network’s discounted fee schedule. So there are no unexpected costs for plan participants, even if they exceed the annual maximum benefit and frequency and age limitations.

Provider Quality

A network is only as good as the quality of the dentists who participate. MetLife’s extensive vetting process before dentists join its network, continual monitoring, and re-credentialing process every three years ensures a stable network that helps provide employees with access to quality consistent care.

Help your small business clients deliver dental benefits that help increase employee satisfaction, retention, and recruitment. To learn more, download the flyer.

Secure a 5% discount on dental rates when bundling a second line of coverage. To learn more about this and other MetLife incentives, contact us today at 800.696.4543 or info@claremontcompanies.com.

Questions?

Contact your Claremont Answer Team at 800.696.4543 or info@claremontcompanies.com.

¹MetLife’s 19th Annual U.S. Employee Benefits Trends Study, 2021.

²Savings from enrolling in a dental benefits plan will depend on various factors including the cost of the plan, how often participants visit the dentist and the cost of services rendered.

³MetLife PDP Plus data as of 2020.

4Based on MetLife internal data.

5Dental Actuarial Analytics, Dental PPO Network Study, 2019 edition.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

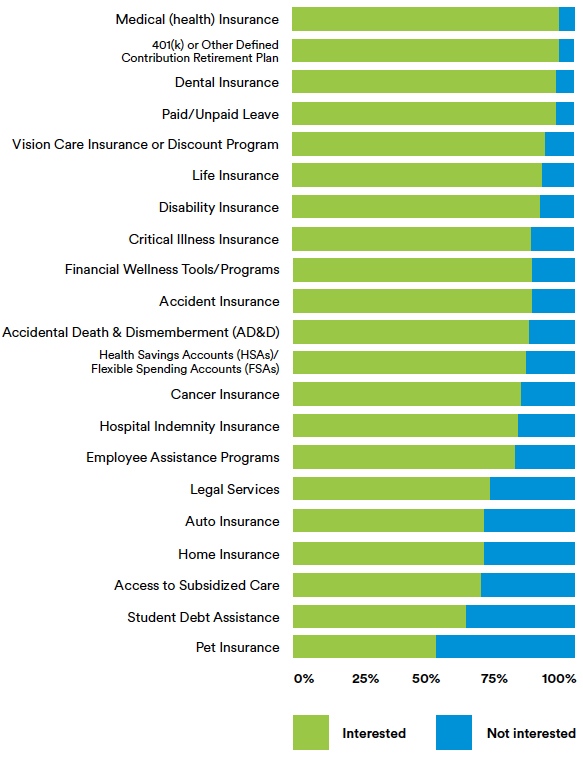

Understanding the everyday experiences of employees and their well-being needs will continue to evolve as we move beyond the pandemic. Employers who focus on the changing needs of their workforce will improve their employees’ physical, mental, financial, and emotional well-being and future-proof their organization.

MetLife’s 19th Annual U.S. Employee Benefit Trends Study 2021, A New Era of Work: Reimagining the Healthcare Employee Experience, provides insights to help you tailor your strategies to guide businesses toward the right path to recover and thrive this year and beyond.

Inside The Study, You’ll Learn:

Benefits Healthcare Employees are Most Interested In

Download the MetLife Study for insights, guidance, and expertise to share with your employer groups. Contact us today to develop tailored benefits solutions that address your clients’ needs.

Questions?

Contact your Claremont Team at 800.696.4543 or info@claremontcompanies.com.

Many employers are subject to state-mandated disability insurance programs and paid leave requirements. Nowadays, with remote workforces often spread across multiple states, employers must understand their obligations to all of their employees wherever they are located.

An employer may provide the minimum benefits required (usually called statutory benefits) or greater benefits under the same or supplemental plan. In California, if an employer chooses to use its own voluntary plan, the plan must exceed State Fund standards in at least one area.

Navigating and complying with the various laws can be complicated – but it doesn’t have to be. To help your clients be compliant and avoid fines and penalties, the MetLife Statutory Leave Benefit Guide will help you provide advice and present solutions. The Guide outlines recently enacted laws, summarizes state-by-state employer requirements, and provides links to more detailed resources.

To learn about the advantages of disability benefits for your clients and prospects, download the Guide.

MetLife Statutory Leave Benefit Guide

MetLife’s broad range of products and service solutions help provide income protection, maximize productivity, and minimize administration for employers of all sizes.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Earn more in 2021 by leveraging the broker bonus programs below.

![]()

Earn points for every sale that qualifies for Blue Shield’s new Small Business Incentive Program (June 2021 to January 2022 effective dates) and other broker bonus programs. Then redeem your points for rewards from hundreds of great options, such as gift cards, electronics, products for your home, and more. Or convert your points to cash with a Visa gift card. Best of all, there are no complicated tiers or calculations required!

You Can Earn

With the Producer Rewards points-based bonus program, each point is equal to one dollar. Plus it’s easy to keep track of your point status and what you’ve earned.

Learn more about the Small Business Incentive Program and Producer Rewards Program. Enroll in the Blue Shield Producer Rewards Program today.

Groups written through Claremont are eligible for this program.

![]()

Earn a $5,000 bonus for groups with 25-100 enrolled employees. Effective dates from July 1, 2021 to September 15, 2021 are eligible. Expires September 15, 2021. Download the Cigna + Oscar Mega Bonus Program flyer.

Earn a $350 bonus for every Cigna + Oscar group with four or more enrolled employees. Effective dates from April 1, 2021 to December 15, 2021 are eligible. Expires December 15, 2021. Download the Cigna + Oscar 2021 Broker Bonus Program flyer.

![]()

Sell Delta Dental’s small group plans, including plans from their new Small Business Program portfolio and qualify for the retention and new sales bonuses. Effective dates from January 1, 2021 to December 31, 2021 are eligible.

Retention Sales Bonus

Retain at least 90% of your book of business through 2021 and earn a bonus on your existing business and qualify for new sales rewards. The more you retain, the more you earn.

New Sales Bonus

Once you’ve met your retention goal, there are three levels of sales rewards. New sales bonuses are based on the number of new groups or total new premium received. And this rewards program is in addition to your existing standard small business commission.

You’ll be automatically enrolled with your first sale. The small business rewards dashboard provides a real-time view of your earnings progress. Expires December 31, 2021. Rewards will be calculated and paid after December 31, 2021. Download the Delta Dental Broker Rewards Program flyer.

![]()

Earn up to $750 when you sell your first dental and/or vision case if you haven’t written a case with Humana in the last 12 months. Groups must be 5+ enrolled. Effective dates from July 1, 2021 through December 31, 2021. Expires December 31, 2021. To learn more, download the Welcome Back Specialty Bonus flyer.

To earn a bonus, sell new specialty lines of coverage with the same employer group and initial effective dates of coverage between August 1 and December 31, 2021.

Place stand-alone specialty lines of coverage or add specialty lines of coverage to a new or existing Humana group medical customer and earn:

Specialty lines of coverage include dental (including voluntary dental), vision (including voluntary vision), life, and accidental death & dismemberment (AD&D). Expires December 31, 2021. To learn more, download the Bundling Bonus flyer.

Earn an initial bonus of up to 5% as a percentage of paid compensable premium and a Specialty Net Growth Factor of up to 140% from a producer’s net gain or loss of enrolled employees.

Eligible products are group term life (including AD&D), group term voluntary/supplemental life (including AD&D), group vision (including voluntary vision), and group dental (including voluntary dental). Expires December 31, 2021. To learn more, download the 2021 Producer Partnership Plan brochure.

Earn Leaders Club points through new medical and qualifying specialty plan sales or Go365 results to qualify for awards including a trip to Banff National Park in Canada for the Leaders Club 2022 event. Effective dates of coverage are from January 1, 2021 to December 31, 2021. Expires December 31, 2021. To learn more, download the 2021 Producer Partnership Plan brochure.

![]()

![]()

Earn 1.5% additional broker compensation when selling dental plus two coverages.

How it works:

No expiration. Download the MetLife Multi-Product Advantage flyer.

![]()

Production Bonus

The more you sell, the higher the bonus factor. Whether you sell several smaller cases or just a few larger cases, you can qualify for a production bonus based on new sale credits for each of these qualifying coverages or services.

Persistency Bonus

The more premium you retain the higher the bonus factor.

Earn one new sale credit for each of these qualifying coverages or services:

Earn one-half credit for voluntary accident or voluntary critical illness. Expires December 31, 2021. Download the Principal Broker Bonus flyer.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

In today’s benefits environment, employers are looking for ways to support their employees’ financial and emotional well-being. MetLife Legal Plans can help your clients address this challenge.

With MetLife Legal Plans Your Groups Will Get:

MetLife Legal Plans provide affordable and convenient legal services that add value — enhancing the competitiveness of the group’s benefits program, help recruit and retain talent, support employees’ financial and emotional well-being, and increase productivity.

When you place the MetLife application (for groups with 10-99 employees) through Claremont, your group can get a 5% discount on dental rates with just one employee enrolling in MetLaw. Some employers even pay for the MetLaw subscription for key employees in order to gain the 5% dental savings.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.