To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

Starting July 1, Covered California for Small Business (CCSB) is offering new Blue Shield plans, providing more options for enrollees. These plans include the Access+ HMO Network with Platinum, Gold, and Silver metal tier options, as well as the Bronze Trio HMO 7000/70. The two most popular Blue Shield High Deductible Health Plans (HDHP), Silver Full PPO Savings 2300/25% and Bronze Full PPO Savings 7000 plans, are also now available.

All of these plans offer benefits such as Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismArticle last updated: April 27, 2023.

Most of your clients likely have upcoming deadlines under federal prescription drug benefits reporting requirements. Here’s a summary of the requirements, how carriers can help, and the deadlines.

Under Section 204 of the 2021 Consolidated Appropriations Act (CAA), insurance companies and employer-based health plans must submit information regarding prescription drug benefits and health care spending. The information must be submitted to the Centers for Medicare and Medicaid Services (CMS) by June 1st of each year for the prior year’s coverage.

Enforcement of the requirements was relaxed for reports due in 2021 and 2022. The requirements for reports due in 2023 are being enforced. Failure to report can lead to a penalty of $100 per day per affected individual.

A detailed summary on the requirements can be found in this helpful Mercer article (many carrier communications that you and your clients are receiving refer to technical terms such as “P2,” “D2-D8,” etc. This article explains these terms).

Each carrier is taking action to support your employer clients with the federal reporting requirements. In order to do so, they require information from each employer group. The approach being taken by each carrier is similar, but varies in detail, including important deadlines. Here’s a summary:

Aetna

Plan sponsors should fill out this RxDC Plan Sponsor Data Collection form with the required data by April 1, 2023. The required data includes the:

Anthem

Anthem is sending emails to Small Group and Large Group fully insured clients and Anthem Balanced Funding clients, asking them to submit monthly average premium information required for Prescription Drug Data (RxDC) reporting. Anthem clients should complete this form before March 24, 2023.

Blue Shield of California

Blue Shield is providing fully-insured groups and self-funded ASO group plan clients an option for collecting and reporting all the required information on their behalf. Groups electing this option must complete a Blue Shield Intake Form. Blue Shield has provided an Intake Form FAQ.

Blue Shield will submit the data report on behalf of fully-insured and self-funded ASO group plans only if the group provides a complete response to the questions on the intake form by March 31, 2023 by 6:00 pm PST. By completing the form, the employer consents that Blue Shield will submit the data on their behalf to the CMS.

If the employer group does not complete the intake form by March 17, 2023, then the employer group will be responsible for submitting all required data directly to the CMS by June 1, 2023.

More details can be found in emails sent recently by Blue Shield directly to brokers and employer groups.

CaliforniaChoice

The information above from CaliforniaChoice was provided verbally. Until this information is formally posted on the CaliforniaChoice website and especially for employers with Kaiser and Sutter enrollment, who are being advised that no action is required, Claremont strongly recommends that brokers contact the carrier and get formal confirmation as to what reporting assistance the carrier will or will not provide. In all cases, it is strongly recommended that the broker or employer request a receipt that the necessary reporting was indeed filed by the carrier. Keep that receipt in the event of a CMS audit.

Cigna+Oscar

Cigna intends to file on behalf of plan sponsors. No action is required of brokers or employers at this time. Look out for future communications from Cigna and Cigna + Oscar.

Covered California for Small Business

Covered California for Small Business (CCSB) is an administrator of its participating health plans and is not subject to RxDC data collection requirements on behalf of employer groups. CCSB has provided the following information for each of their participating health plans:

More details can be found in this April 11, 2023 CCSB broker email.

Kaiser Permanente

Kaiser Permanente (KP) needs to collect certain data in order to submit all applicable reports and required responses on behalf of employers. Employers with KP coverage in 2022 should complete this form no later than April 3, 2023. The broker can also complete the form on behalf of the employer. Once KP has the necessary data, it will submit all applicable reports and required responses to the CMS by the June 1, 2023 deadline.

Note: Kaiser asks for the data in a different way than other carriers. To help simplify the process, Claremont has created a worksheet (Excel, PDF) with instructions. If the broker or employer can assemble three pieces of data for each month in 2022, they can enter those into the worksheet and it will calculate the answers for Questions 8 and 9 which can then be entered into the Kaiser form.

Sharp Health Plan

Sharp Health Plan will be contacting their employer groups directly to obtain the required information. In addition, they will be sending a broker and employer alert informing all brokers and employers of the RxDC reporting requirement.

UnitedHealthcare

UnitedHealthcare (UHC) will assist clients by submitting all required information to the CMS if the employer completes UHC’s Pharmacy and Benefits and Costs Survey by March 10, 2023.

UHC sent an email communication on February 3, 2023 to all brokers/groups with fully-insured and Level-Funded plans instructing them of the data collection and action required to complete the Survey. Here is a link to the FAQs from UHC. It also links to the survey. Once the survey is complete, UHC will submit the necessary data to the CMS on behalf of the employer prior to the June 1, 2023 deadline.

The carriers are taking action to support your clients with the federal reporting requirements. In order to do so, they require information from each employer group. Look out for emails directly from the carriers, and follow their instructions. If you or your clients have questions, we can help direct you to the right contacts at the carriers.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Starting April 2023 and continuing for one year, Medi-Cal, in a process called continuous coverage unwinding (CCU), will re-assess eligibility for 15 million Californians. For upwards of one million of them, it’s expected that enrolling in a group health plan will be their best, and maybe only option for affordable coverage. This is a singular event that gives you an opportunity to deepen client relationships, acquire more customers, and grow your business.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

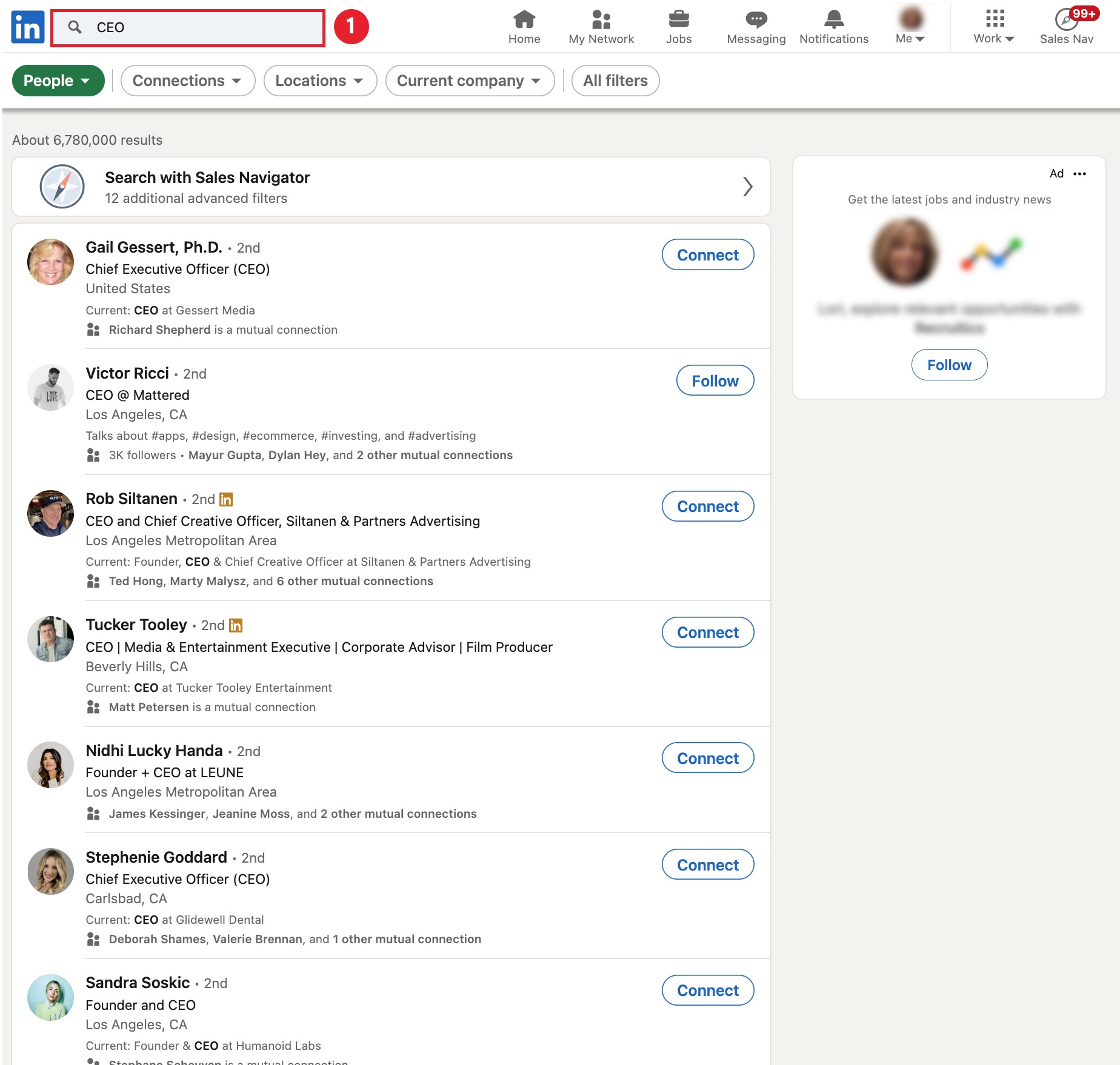

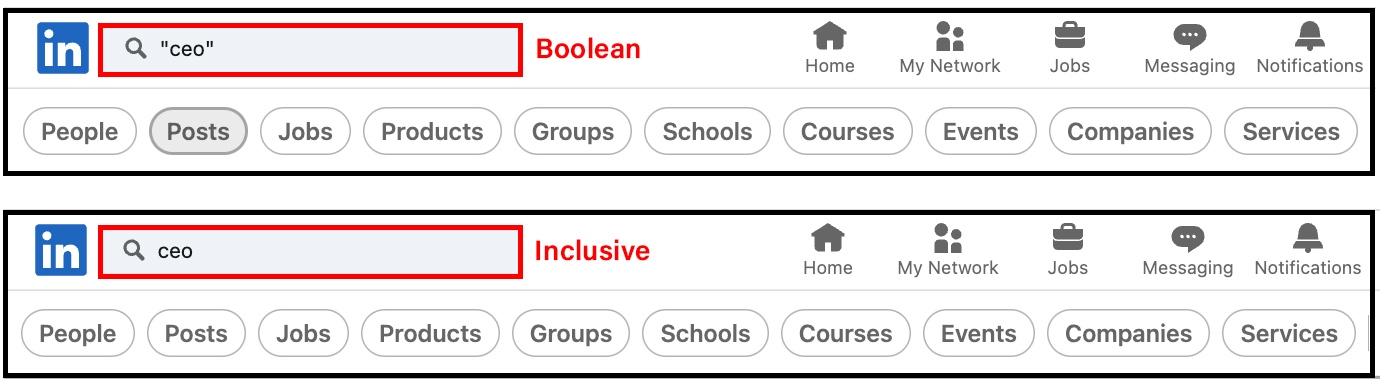

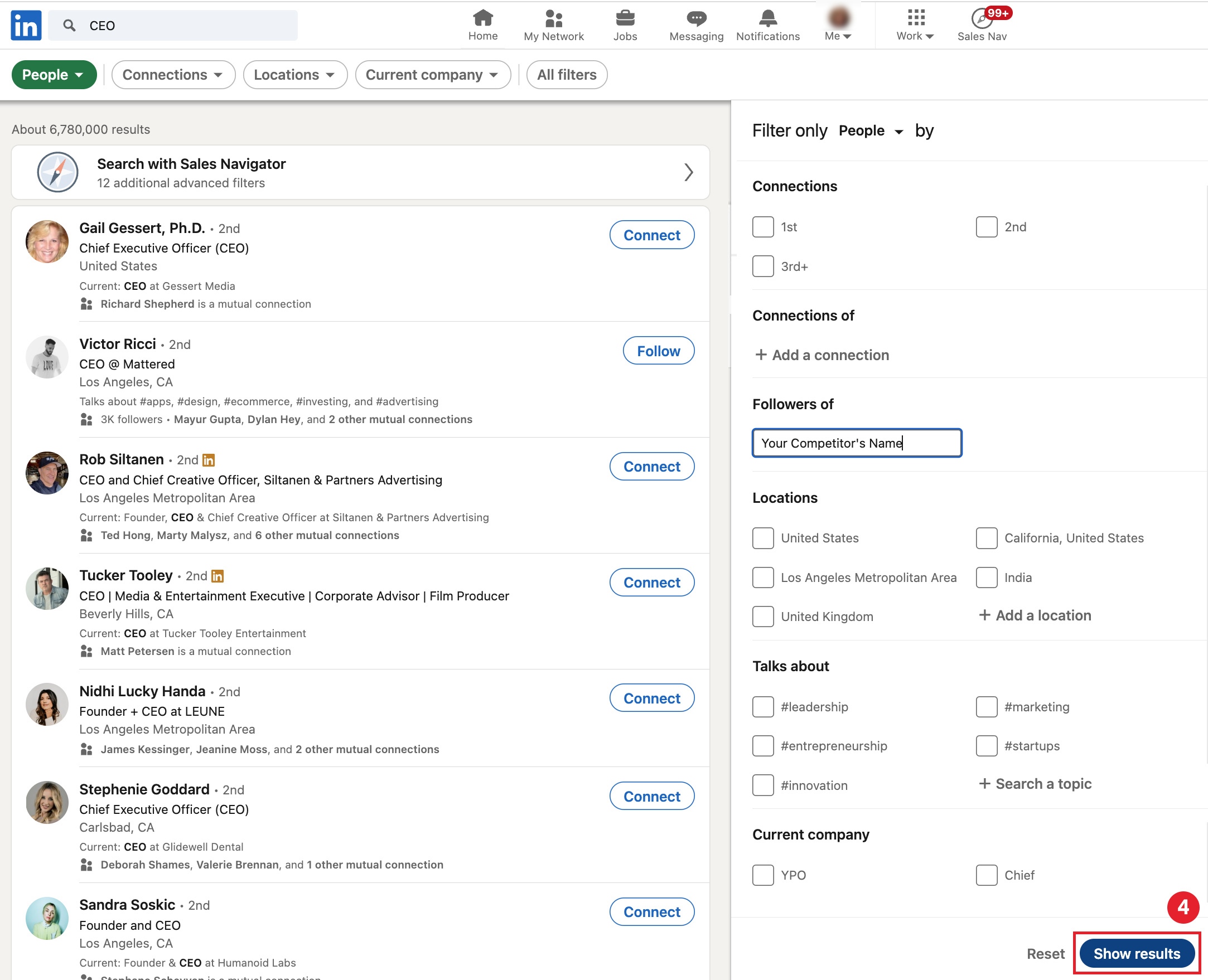

As the leading social platform focused on business and professional networking, LinkedIn (830 million users) is one of the top places to reach decision makers, influencers, and practitioners. In fact, B2B blogs and websites receive most of their social media traffic from LinkedIn, according to a 2022 LinkedIn study. 43% attribute their sales to LinkedIn, Facebook followed at 24%, and Twitter at 20%.

If your prospects are active on LinkedIn, chances are they’re talking about the issues you can solve. So, if you can find them, reaching out becomes easier because you know they are more likely to be open to your solutions.

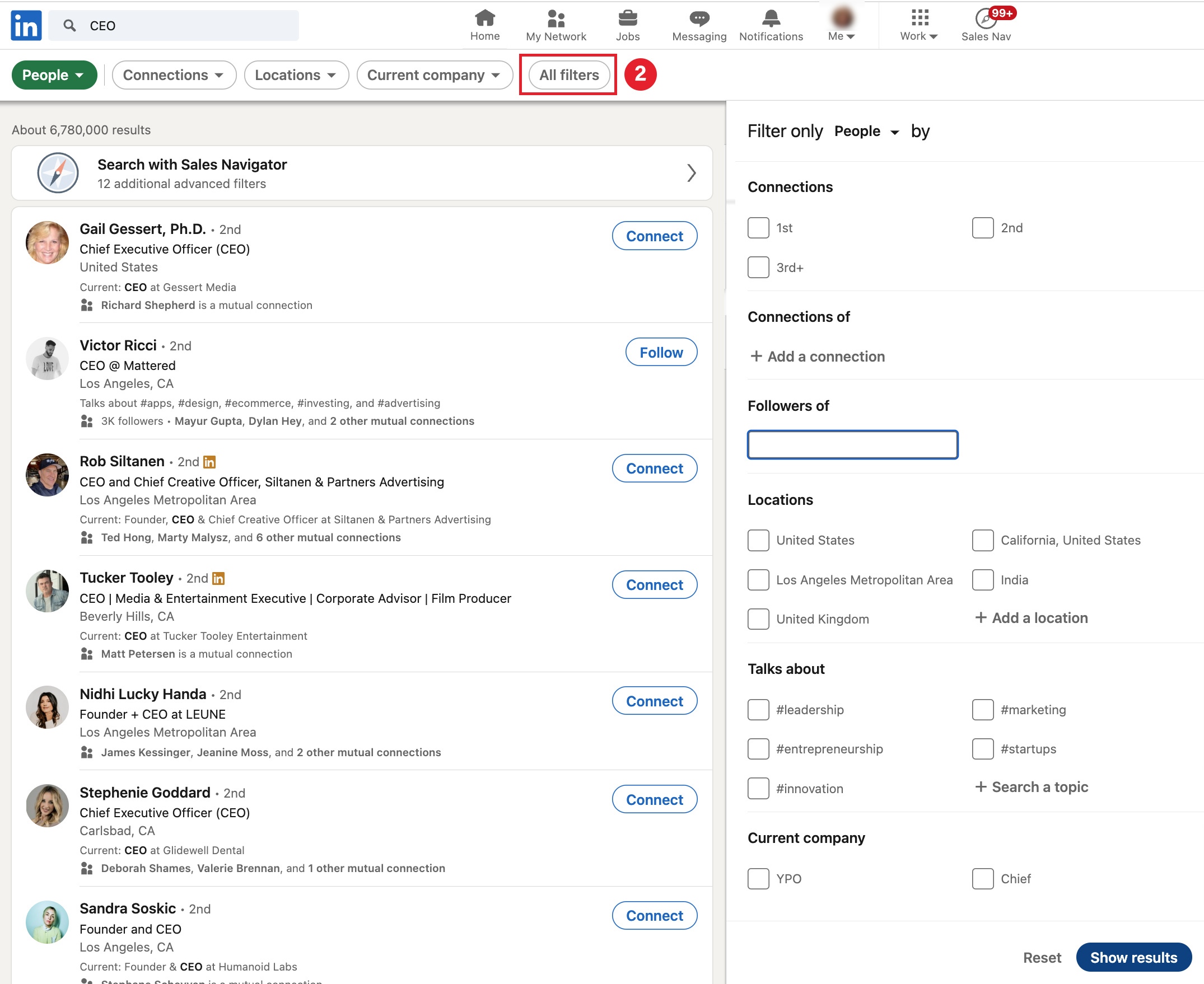

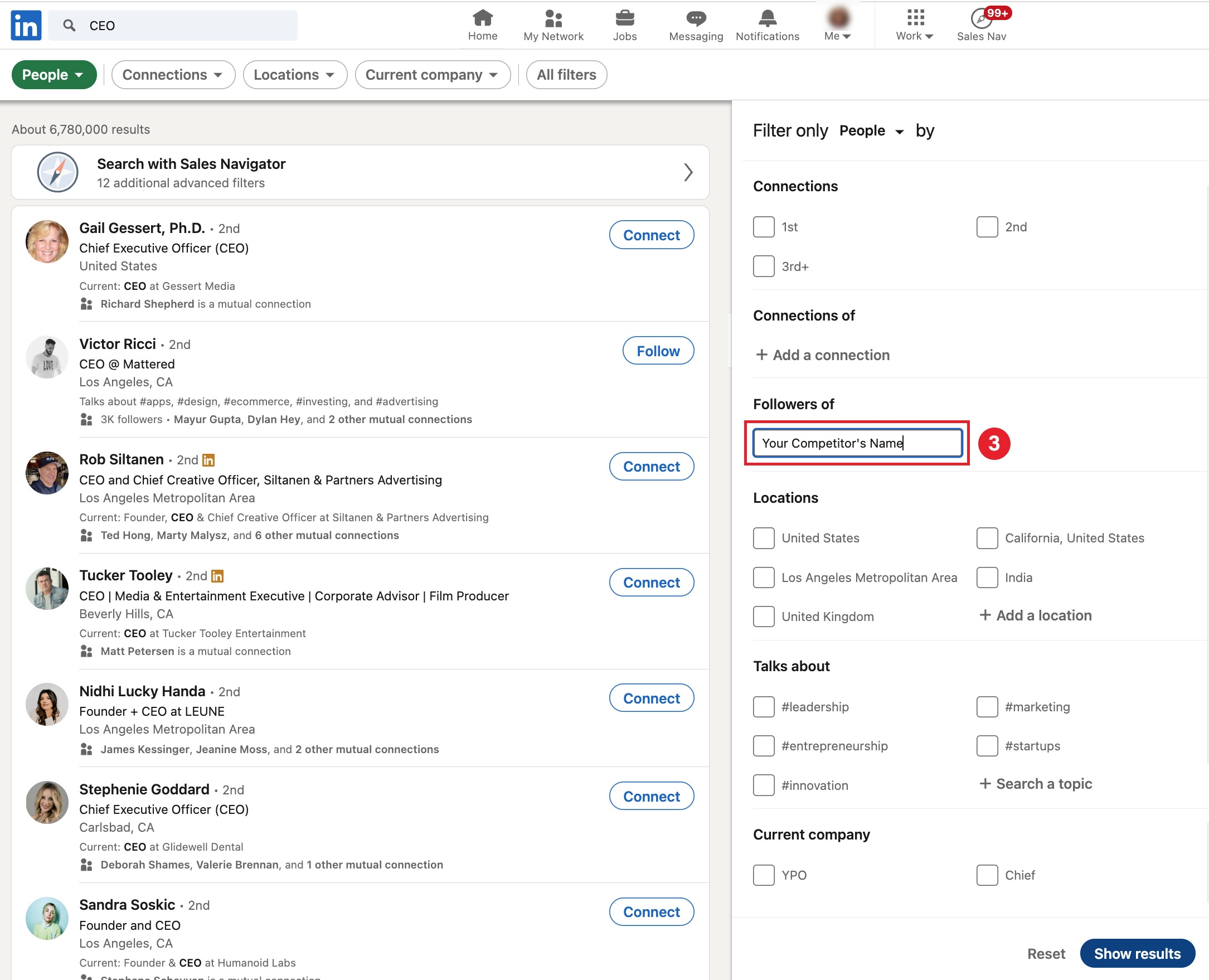

To start building an organic audience that will later convert to clients, follow the tips below.

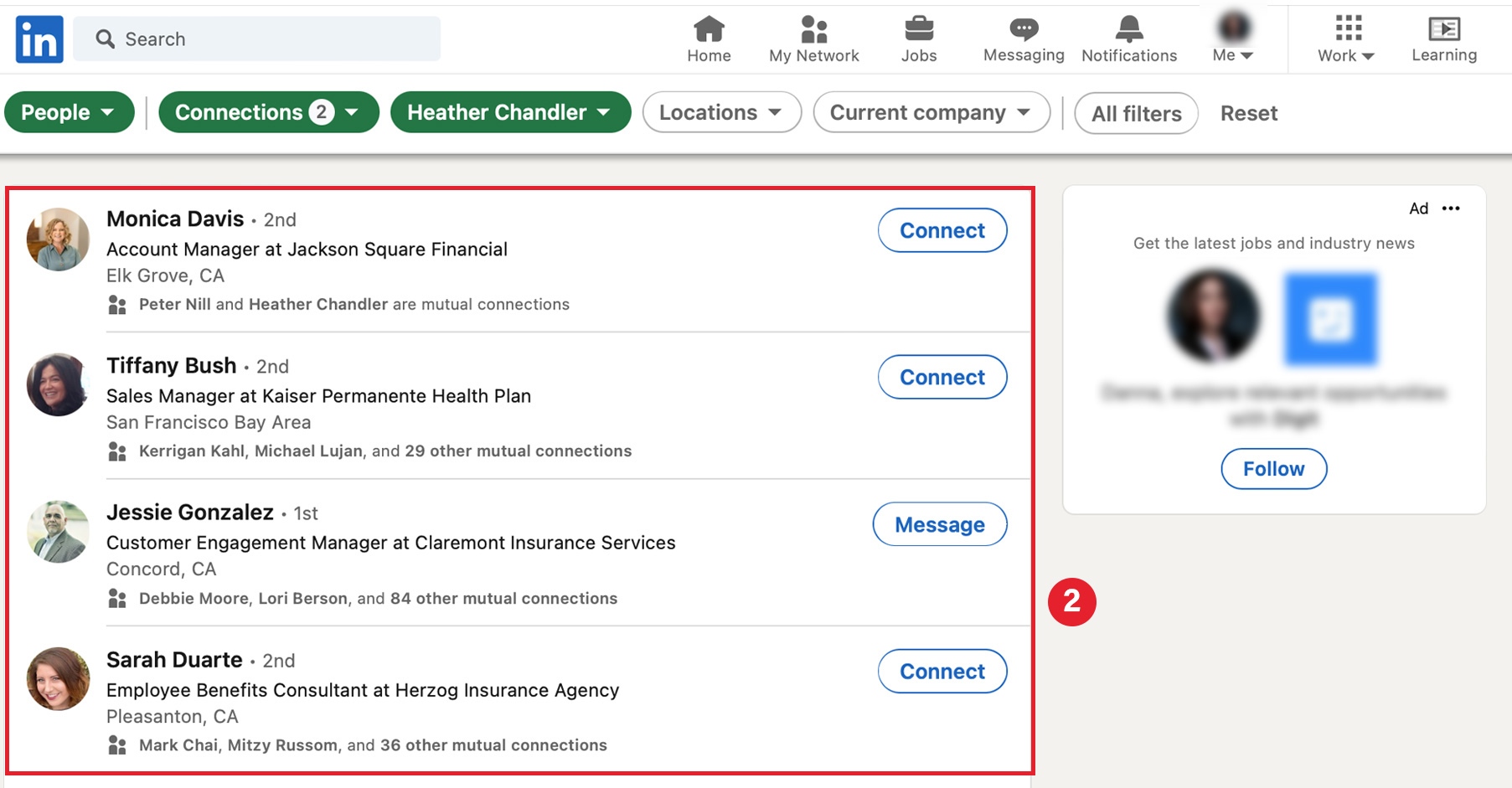

Now you have a list of potential prospects who follow your competitor(s). Make sure to remove any employees or founders from the followers list. LinkedIn doesn’t have an export feature, but you can use a third party app like PhantomBuster.com.

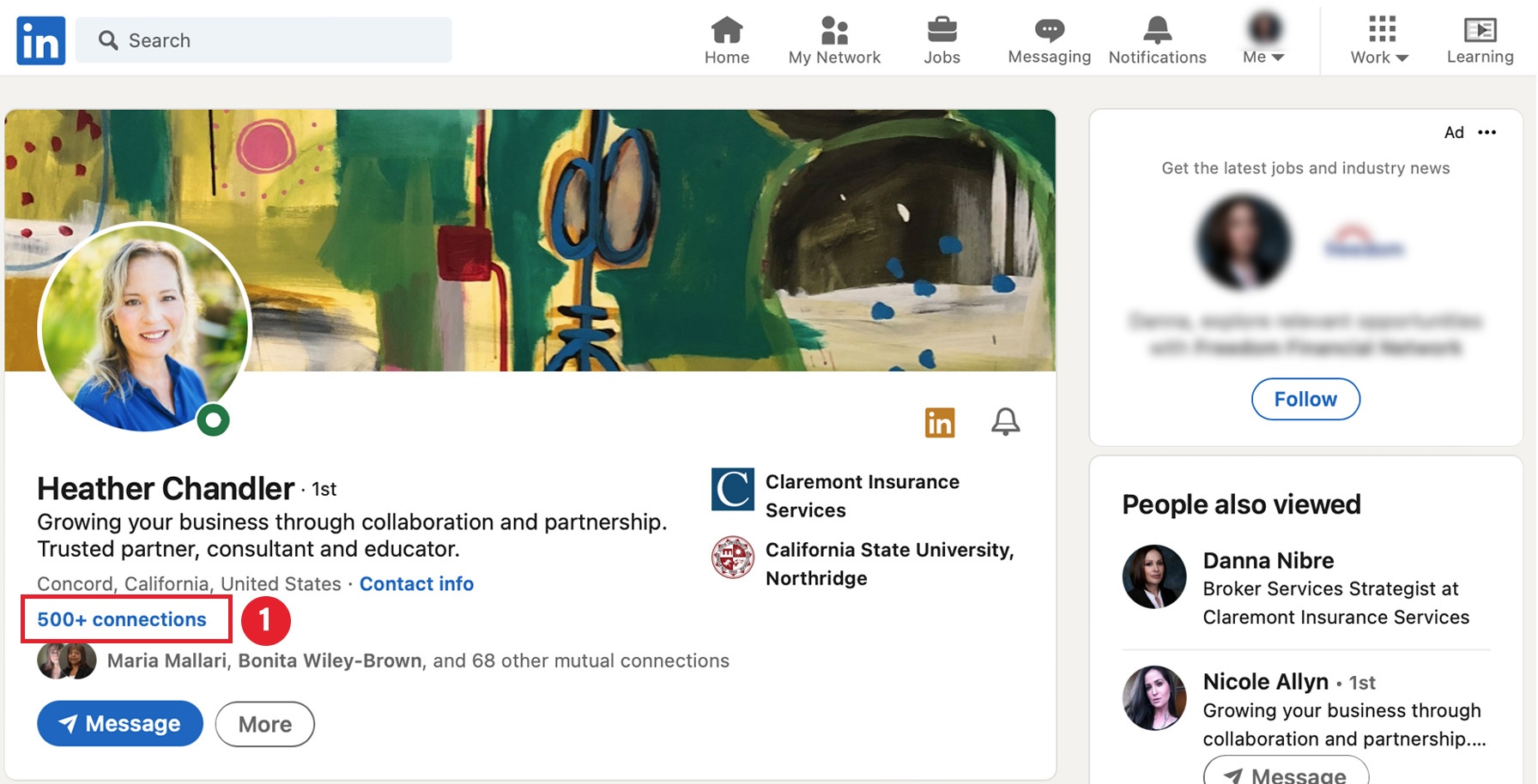

LinkedIn member’s networks are searchable (if they haven’t opted to hide them).

Before requesting connections and reaching out to any prospects, use our profile optimization framework to Turn Your Profile Into a Business Growth Machine.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Tune in to this NABIP Compliance Corner webinar on Thursday, March 16th at 10:00 am PDT, when NABIP members Barb Gerken and Samantha Malovrh walk you through what you need to know about RxDC Reporting and the end of the COVID public health emergency.

Don’t miss out. Register now!

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

It’s now even easier to present compelling quotes and proposals to your clients when you log into PRISM, our (no-cost) quote service, with these new enhancements.

1. Easily export multiple reports on the Table Rates & Benefits Report page (available before selecting a group) into Excel.

Once you checkmark the corresponding outputs, you will be able to select “Excel Export (beta).”

This feature can be used with multiple reports at once, and will export all selected reports into a combined Excel spreadsheet with each tab being its own report.

2. Filter Current Plans on the Review Group Data page by Carrier, Plan Type, and Metallic Tier. Previously, you could only filter Current Plans by Carrier. This update allows the user to narrow their filtering significantly while searching for their group’s current plan selections. This feature not only makes plan mapping more efficient and user friendly, but also helps avoid errors in plan selections due to too many options.

3. Sort the Side-by-Side reports so the Current and corresponding Renewal Plans are next to each other. Previously, that report would show all Current plans and then all Renewal plans before including any alternative plans. The image below shows where you select this option in the Medical Plan Reports.

Side-by-Side example of the new Current/Renewal on the left. On the right, there is no sorting by Current/Renewal.

4. Narrow down the plans to include on the Employee Worksheet ACA report in two ways (by Package or now by Plans selected during the quoting process). You can also narrow down the Base Plan for that report in two ways (by Package or now by only the selected/highlighted Plans within the Package).

Selecting the package will ensure mixed packages are not offered.

If you ran a quote previously, you can choose “By Selected Plans from Above” and this will shorten the time instead of having to re-select the plans individually.

5. The cost comparison now includes the Network. This allows you to identify if the Network is full (Broad) or skinny (Narrow).

Whether you need help onboarding new staff or learning how to use PRISM’s advanced features, our short on-demand video tutorials will quickly get you the training you need when you need it.

To take advantage of PRISM, our free online quoting system. Or request a quote by contacting us at 800.696.4543 or quotes@claremontcompanies.com.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

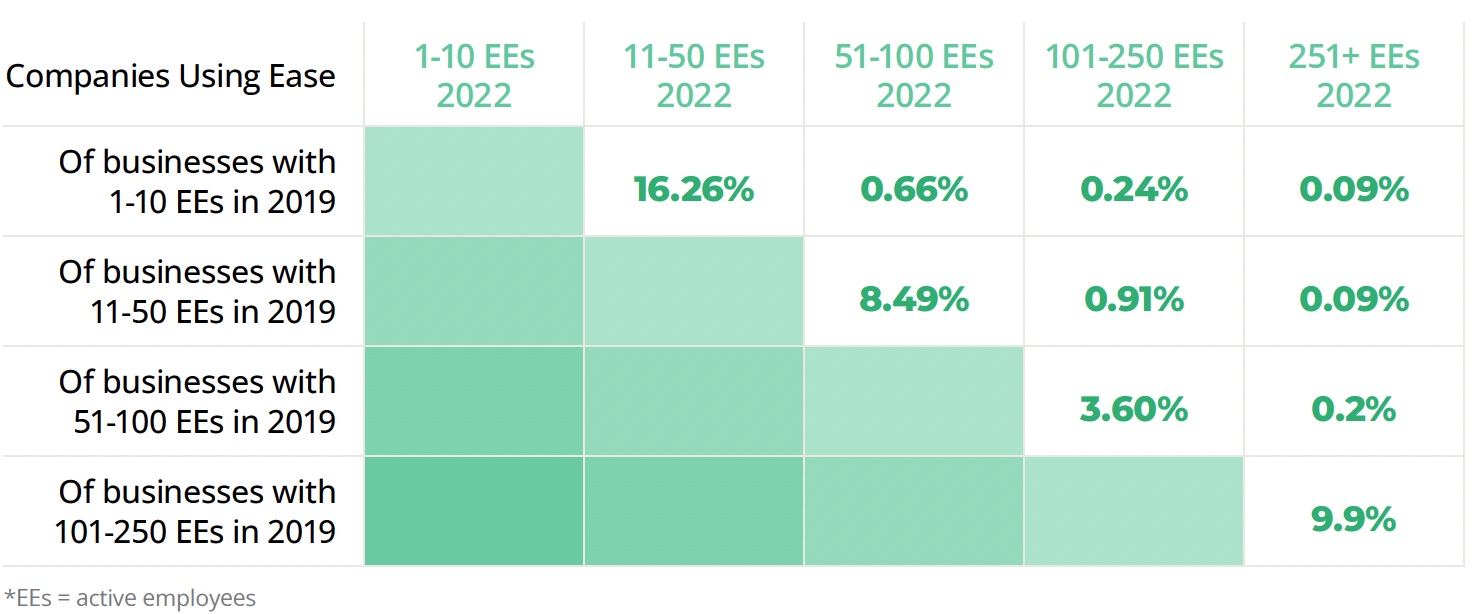

According to the recently released Ease 2023 SMB Benefits and Employee Insights Report, that focuses on the evolving benefits landscape for businesses with 1-250 employees, the smallest businesses are seeing the biggest medical premium increases. The report also offers insights into the benefits pressures employers and employees face and shares data to help you and your clients make informed decisions for the coming year.

With anonymized data collected from more than 2,300 health insurance agencies, 85,000 businesses, and 3.4 million+ employees nationwide that use Ease, the Report found medical premiums continue to climb, employees today expect their organizations to recognize their lives inside and outside of work, and employers and employees are asking more and more of each other.

A cooling job market, hints of a coming recession, unclear return-to-office plans, supply chain disruptions, and inflation, will continue to be challenging for small-to-medium businesses (SMBs).

Brokers who succeed will be the ones who stay out in front and offer benefits that matter to their clients – all while keeping an eye on the bottom line. To do this, they must rely on data-driven insights to learn from what’s come before and what could come next.

You’ll Find Features Insights and Trends On:

Medical premiums are experiencing cost increases much like everything else. Since 2018, individual premiums saw a 21% increase, while family premiums have a slightly lower increase at 17.87% over the same time period. That’s a $104 per month increase for individuals and a $231 per month increase for families — or $1,248 and $2,772 per year — significant for any household.

While the jump in average premiums from 2021 to 2022 fell under the 6.5% rate of inflation, the smallest employer groups were dealt the hardest blow. Employers with only 1-10 employees saw an increase of 12.07%. That’s nearly double the rate of inflation and the largest increase this segment has experienced in the past four years.

Continuing the trend seen since 2018, the smaller the company the more their employees paid toward benefits. Employees working for companies with 101-250 employees paid 37% less than those working for companies with 1-10 employees this past year.

When it comes to plan-type adoption, HMOs and PPOs remain the most popular choice for employees, more than 50% of SMB employees opted to waive coverage entirely, up 13% from 2020.

Though the uptake of consumer-driven health plans remains a small slice of the pie, participation in High Deductible Health Plans (HDHPs) has increased 68% year-over-year. Panning out, HDHPs typically combine with a Health Savings Account (HSA). Given the current state of the economy, households may be opting to use higher deductible plans to save money on their monthly premiums in spite of the higher financial risk if a major medical event occurs. More money in their pockets each month seems like a safer bet.

On average, businesses with more employees offered more medical plans than those with fewer employees in 2022.

Non-medical voluntary benefits offer SMBs a unique way to meet the needs of their employees without destroying their budgets. Must-haves like dental, vision, and life top the list for SMB employees, but lifestyle benefits like financial wellness, legal services, and pet insurance continue to gain steam.

Vision coverage continues to see a decrease year-over-year in premium cost. Short-term disability saw the biggest jump from 2020 to 2022 at almost 12% ($2.75 per month, or $33 more annually).

Similar to the trend seen with medical plans, the larger the company, the more voluntary benefits plans offered per employee in 2022.

Groups in Ease experienced a nominal increase in the average number of employees. While all segments have seen a small uptick in employees from 2021 to 2022, all fluctuations are within one point when looking at a three-year trend line. Outside of Ease, SMBs experienced a net job loss of 3 million,* or a shrinking of 5% of the total workforce.

Ease looked at companies using their system since 2019. Overall, 13.29% of companies using Ease grew, while 7.68% shrank over the same period.

By using the data from Ease’s survey of 1,000 U.S.-based employers and employees, you’ll be able provide options and ongoing management support year-round to recession-proof your business.

Employers (ERs) and Employees (EEs) top benefits priorities in 2023:

Employer expectations for year-round support continue to increase. In fact, only 6% of employers surveyed think their broker is needed only during open enrollment. That means 94% expect consultation, innovation, and ongoing management support year-round.

37.52% of agencies offered more support to clients this year than last year by helping them onboard new hires online, conducting benefits elections remotely, and providing compliance support.

78% of agencies anticipate their groups wanting more insurance options this upcoming enrollment season:

73.77% of employers believe benefits administration technology is a higher or equal priority going into this year’s open enrollment.

For a deeper understanding of the latest employee benefits trends and to better advise your clients, download the Ease 2023 SMB Benefits and Employee Insights Report.

Ease is an online benefits enrollment system that makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

The Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

*U.S. Small Business Administration Office of Advocacy, 2022 Small Business Profile Infographic

Social selling is about finding, engaging, and connecting with your target audience through social media. It can help you better qualify prospects, expand your reach and raise awareness, promote your company, engage with prospects and clients, conduct research, gain trust, and establish relationships to increase sales.

With over 830 million members, LinkedIn is the only platform focused on business and professional networking and it’s an essential tool for brokers looking to connect with potential clients. In fact, it’s one of the top places to reach decision makers, influencers, and practitioners.

According to Hubspot, B2B blogs and websites receive most of their social media traffic from LinkedIn. And 43% attributed their sales to LinkedIn, Facebook followed at 24%, and Twitter at 20%.

There is no ‘silver bullet’ for attracting LinkedIn leads. Instead you’ll need a combination of strategies to establish yourself on the platform and get in front of your target audience. To help, here’s our first Social Selling Tips article on how to turn your profile into a business growth machine.

An Optimized Professional LinkedIn Profile:

Your profile should be a landing page that focuses on the needs of your prospects and clients. Make sure to include all of your contact details and keep it up to date. It does influence sales!

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Ease, an online benefits enrollment system, makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

What’s more, the Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Why Over 2,300 Agencies Trust Ease to Grow Their Business

Save Your Clients Time and Increase Employee Engagement

Download the Ease flyer to learn more.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Please join us in celebrating the 30th work anniversary of Claremont President Michael Traynor.

Michael joined Claremont in 1993 as one of our founding employees and has since guided the company – and helped our customers grow and thrive – through many rounds of industry change during the last 30 years.

From company Chairman Bob Traynor: “I founded Claremont back in the early 1990s to help brokers build their health benefits businesses. Michael was one of our first employees, and I might be biased, but he turned out to be one of the best hires we made. Thank you Michael for carrying on the good work!”

From industry veteran Michael Lujan: “I think I speak for the whole industry when I say thank you Michael for your long-term and consistent support of California’s independent brokers and agents. Congratulations Michael on thirty years at Claremont!”

Please join us in wishing Michael a happy 30th work anniversary!

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

We are excited to welcome Suzie Wirths as the newest addition to the Service Team. As a Broker Service Representative, Suzie will assist clients in a variety of areas such as eligibility, enrollment support, quoting, carrier knowledge, Ease and more.

Suzie has over six years of employee benefits experience and has worked with Third Party Administrators as well as brokerage firms. “After her first interview, I knew Suzie should be a part of our team,” says Laura Hogsed, Service Manager. “Her experience and knowledge are only part of what Suzie brings to the table. She strives to provide the best possible experience to everyone that she interacts with and she is eager to make an impactful contribution to our customers. Our clients are already saying how much they enjoy working with her.”

Suzie loves the outdoors. In her spare time, you may find her hiking, kayaking, caving and exploring the mountains.

You can reach Suzie at suzie@claremontcompanies.com or 925.348.0856.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.